Loading

Search

▼ Japan Move Shows Limit of Central Bank Powers

- Category:Other

TOKYO — Japan’s central bank has revealed yet another exotic weapon to generate growth, but skeptics say all it shows is that the armoury is empty and a long battle against deflation is being lost.

With the European Central Bank apparently set to embark down a similar path and the Federal Reserve treading very lightly, some analysts are saying the Bank of Japan’s move is an admission of defeat and a warning of the limits of central bank power.

After a hotly anticipated meeting on Wednesday, the BOJ said it would switch its emphasis from interest rates and concentrate its firepower on 10-year government bonds.

BOJ Governor Haruhiko Kuroda said the bank would buy as many or as few of these benchmark instruments as necessary to ensure the yield—the interest rate paid to holders—remained steady at around zero.

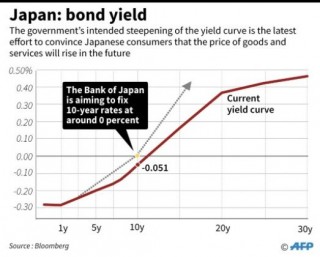

He also pledged he would cut back on the number of longer dated bonds the bank holds. That should reduce the price of long-term securities, which—in turn—should increase their yield.

This so-called steepening of the yield curve is the latest effort to convince Japanese consumers that the price of goods and services will rise in the future.

The idea is that if people think prices will rise, they’ll rush out to spend their money, causing actual price rises.

But the problem, say analysts, is that after more than three years of bootlessly insisting that inflation is coming back (it’s barely budged) Kuroda is low on credibility.

“It’s hard not to see the BOJ statement as a further sign that it is running out of ideas,” said George Magnus, an adviser to UBS Group AG, Bloomberg reported.

Japan has been grappling with stagnant or falling prices for much of the last quarter of a century, since an asset and stock bubble popped after decades of soaraway growth.

The prospect of things being cheaper next month discourages consumers from spending their money right now, making companies reluctant to invest and pressuring a country’s economic growth.

The government—through its so-called “Abenomics” growth plan—and the central bank have been tinkering with their monetary and fiscal policy for years in a bid to encourage people to open their pocketbooks.

But, says Barry Bosworth of the Washington-based Brookings Institution, they’re missing the point.

“It’s hard not to see the BOJ statement as a further sign that it is running out of ideas,” said George Magnus, an adviser to UBS Group AG, Bloomberg reported.

Japan has been grappling with stagnant or falling prices for much of the last quarter of a century, since an asset and stock bubble popped after decades of soaraway growth.

The prospect of things being cheaper next month discourages consumers from spending their money right now, making companies reluctant to invest and pressuring a country’s economic growth.

The government—through its so-called “Abenomics” growth plan—and the central bank have been tinkering with their monetary and fiscal policy for years in a bid to encourage people to open their pocketbooks.

But, says Barry Bosworth of the Washington-based Brookings Institution, they’re missing the point.

“I do not think that the solution to Japan’s economic stagnation lies with changes in monetary policy,” he said.

“The larger problem is in the weak level of corporate investment, which, when combined with high retained earnings, has a major depressive effect on the economy.”

Companies are not going to start spending their cash piles—either by investing or boosting wages—until they think there are consumers willing to buy the goods and services they are selling.

“Ultimately, the BOJ does not operate in a vacuum,” said a research note from Daiwa Capital Markets.

That’s where the structural reforms promised—but not really delivered—by Abenomics should come in.

“Given the relatively limited support coming from fiscal policy; Japan’s woeful demographics and other structural weaknesses; the weakness of global demand… we very much doubt that inflation” will return in any meaningful way.

The bad news for other developed economies is that Japan is ahead of the curve.

It may have been the first place to enter a period of prolonged deflation, but wobbly performances from Europe and the United States in recent years have sent their economies in the same direction.

Both the Federal Reserve in the US and the European Central Bank have implemented ultra low interest rates and quantitative easing. Neither has seen impressive results.

“The larger problem is in the weak level of corporate investment, which, when combined with high retained earnings, has a major depressive effect on the economy.”

Companies are not going to start spending their cash piles—either by investing or boosting wages—until they think there are consumers willing to buy the goods and services they are selling.

“Ultimately, the BOJ does not operate in a vacuum,” said a research note from Daiwa Capital Markets.

That’s where the structural reforms promised—but not really delivered—by Abenomics should come in.

“Given the relatively limited support coming from fiscal policy; Japan’s woeful demographics and other structural weaknesses; the weakness of global demand… we very much doubt that inflation” will return in any meaningful way.

The bad news for other developed economies is that Japan is ahead of the curve.

It may have been the first place to enter a period of prolonged deflation, but wobbly performances from Europe and the United States in recent years have sent their economies in the same direction.

Both the Federal Reserve in the US and the European Central Bank have implemented ultra low interest rates and quantitative easing. Neither has seen impressive results.

The Fed’s latest salvo after its meeting on Wednesday was to do nothing.

In an opinion piece on Bloomberg News, Lisa Abramowicz said this week’s moves show the limits on central bank power in the absence of any political leadership.

“Together the Fed and the BOJ have made clear that they have gone about as far as they are able or willing to go to fill in the gap left by inaction by lawmakers worldwide,” she said.

“In short, these central bankers are essentially throwing in the towel with respect to searching for ever more creative solutions or making waves.

“Even if these bankers don’t explicitly back away from their efforts, they’ve reached their limits. It’s the politicians’ turn now.”

© 2016 AFP

In an opinion piece on Bloomberg News, Lisa Abramowicz said this week’s moves show the limits on central bank power in the absence of any political leadership.

“Together the Fed and the BOJ have made clear that they have gone about as far as they are able or willing to go to fill in the gap left by inaction by lawmakers worldwide,” she said.

“In short, these central bankers are essentially throwing in the towel with respect to searching for ever more creative solutions or making waves.

“Even if these bankers don’t explicitly back away from their efforts, they’ve reached their limits. It’s the politicians’ turn now.”

© 2016 AFP

- September 24, 2016

- Comment (0)

- Trackback(0)