Loading

Search

▼ Convenience Stores Buck Poor Sales Trend

- Category:Shopping

By Kentaro Kuroki / Yomiuri Shimbun Staff Writer

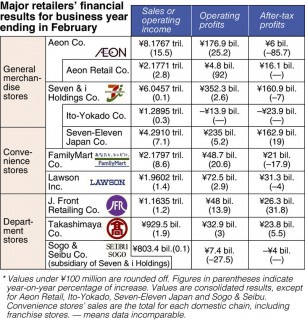

Convenience store operators continued to enjoy solid performances for the business year ending February as general merchandise stores and department stores suffered poor sales, according to the financial reports of major retailers released by Wednesday.

Compared to convenience stores, general merchandise stores faced a shrinking customer base. Department stores faced sales declines, except for the benefits of “explosive shopping sprees” by foreign visitors.

Lawson Inc. announced Wednesday that it posted a record high operating profit of ¥72.5 billion, up 2.9 percent from the previous year.

“We’ve achieved solid performance because we boosted our product development and sales floors,” President Genichi Tamatsuka said during a press conference that day.

Although consumers have been spending less, major convenience store operators enjoyed operating profits because they have been honing their strength — convenience — by offering new products and services.

Lawson saw increases in sales of products its operator developed independently, most notably smoothies designed to cater to customers with a high level of health consciousness.

Two other major operators — Seven-Eleven Japan Co. and FamilyMart Co. — also enjoyed record operating profits.

FamilyMart had brisk sales in bento meal boxes and prepared foods. To boost that segment, the operator will call for bento makers to invest more capital in keeping vegetables and other ingredients fresher.

Convenience stores have continued to expand sales amid national deflation that began in the 1990s. According to the Japan Franchise Association, their sales nationwide exceeded ¥10 trillion for the first time in fiscal 2014, surpassing the about ¥4 trillion in department store sales and approaching the ¥12.94 trillion in supermarket sales.

Convenience store operators continued to enjoy solid performances for the business year ending February as general merchandise stores and department stores suffered poor sales, according to the financial reports of major retailers released by Wednesday.

Compared to convenience stores, general merchandise stores faced a shrinking customer base. Department stores faced sales declines, except for the benefits of “explosive shopping sprees” by foreign visitors.

Lawson Inc. announced Wednesday that it posted a record high operating profit of ¥72.5 billion, up 2.9 percent from the previous year.

“We’ve achieved solid performance because we boosted our product development and sales floors,” President Genichi Tamatsuka said during a press conference that day.

Although consumers have been spending less, major convenience store operators enjoyed operating profits because they have been honing their strength — convenience — by offering new products and services.

Lawson saw increases in sales of products its operator developed independently, most notably smoothies designed to cater to customers with a high level of health consciousness.

Two other major operators — Seven-Eleven Japan Co. and FamilyMart Co. — also enjoyed record operating profits.

FamilyMart had brisk sales in bento meal boxes and prepared foods. To boost that segment, the operator will call for bento makers to invest more capital in keeping vegetables and other ingredients fresher.

Convenience stores have continued to expand sales amid national deflation that began in the 1990s. According to the Japan Franchise Association, their sales nationwide exceeded ¥10 trillion for the first time in fiscal 2014, surpassing the about ¥4 trillion in department store sales and approaching the ¥12.94 trillion in supermarket sales.

Convenience stores have enjoyed a positive growth cycle, whereby more customers are lured in as more new services are introduced. These include installing ATMs and providing spots for customers to receive their online shopping purchases.

Failure to meet needs

General merchandise stores, on the other hand, have found it difficult to emerge from stagnation.

Aeon Group’s general merchandise arm suffered a year-on-year decrease of 19 percent in operating profits, posting just ¥9.3 billion. Ito-Yokado Co., an arm of Seven & i Holdings Co., posted its first ever deficit.

General merchandise stores “offer everything from food to clothes and daily necessities, but fall short of presenting something customers really want,” one analyst said.

In contrast to convenience stores, which have been honing their strengths, general merchandise stores have been unable to develop products or services that “other retailers cannot provide,” he added.

“We cannot fully meet customers’ needs,” Aeon Co. President Motoya Okada said at a press conference Wednesday.

Aeon aims to offer more prepared meals using ingredients from local communities where its stores are located, in addition to more daily necessities that better meet the different lifestyles of those areas. However, the operator failed to fully shift to this approach, mainly because it has a large number of stores.

Department stores have also stagnated, although they did benefit from explosive shopping sprees. At Daimaru Matsuzakaya, an arm of J. Front Retailing Co., sales decreased 2 percent from the previous year except for duty-free items for foreign visitors.

At Takashimaya department stores, clothing sales — which account for 30 percent of overall sales — dropped 3 percent from a year earlier.

As income remains stagnant, consumers are more demanding about price and quality when selecting products that can better meet their needs.

“Consumers seek items that are fashionable and high quality but also reasonably priced,” an industry source said. In contrast, department stores traditionally offer high-quality, high-priced items.

“We’ve been lagging behind in responding to changes in consumer behavior,” a department store executive said.

Failure to meet needs

General merchandise stores, on the other hand, have found it difficult to emerge from stagnation.

Aeon Group’s general merchandise arm suffered a year-on-year decrease of 19 percent in operating profits, posting just ¥9.3 billion. Ito-Yokado Co., an arm of Seven & i Holdings Co., posted its first ever deficit.

General merchandise stores “offer everything from food to clothes and daily necessities, but fall short of presenting something customers really want,” one analyst said.

In contrast to convenience stores, which have been honing their strengths, general merchandise stores have been unable to develop products or services that “other retailers cannot provide,” he added.

“We cannot fully meet customers’ needs,” Aeon Co. President Motoya Okada said at a press conference Wednesday.

Aeon aims to offer more prepared meals using ingredients from local communities where its stores are located, in addition to more daily necessities that better meet the different lifestyles of those areas. However, the operator failed to fully shift to this approach, mainly because it has a large number of stores.

Department stores have also stagnated, although they did benefit from explosive shopping sprees. At Daimaru Matsuzakaya, an arm of J. Front Retailing Co., sales decreased 2 percent from the previous year except for duty-free items for foreign visitors.

At Takashimaya department stores, clothing sales — which account for 30 percent of overall sales — dropped 3 percent from a year earlier.

As income remains stagnant, consumers are more demanding about price and quality when selecting products that can better meet their needs.

“Consumers seek items that are fashionable and high quality but also reasonably priced,” an industry source said. In contrast, department stores traditionally offer high-quality, high-priced items.

“We’ve been lagging behind in responding to changes in consumer behavior,” a department store executive said.

- April 16, 2016

- Comment (0)

- Trackback(0)