Loading

Search

▼ Market Would Have Been Worse Without Negative Rate, Kuroda Says

- Category:Other

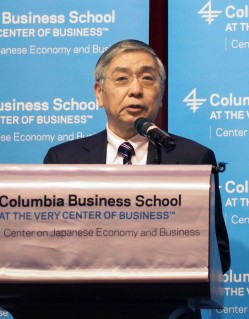

The nation’s financial markets would have been in worse shape if the Bank of Japan had not adopted a negative interest rate, BOJ Gov. Haruhiko Kuroda said, rejecting suggestions the new policy has been counterproductive.

“I really don’t think that the introduction of the negative interest rate backfired or caused the yen to appreciate and stock markets to decline in Japan,” Kuroda said during a question and answer session at Columbia University in New York. “If anything, I can say that if we didn’t introduce the QQE with the negative interest rate, financial markets in Japan would have been even worse.”

The yen has rallied almost 11 percent since Jan. 29, when the BOJ announced it would charge financial institutions for a portion of the funds that they park at the central bank. The Topix share index has fallen 5 percent, while the banking index has plunged 15 percent. Although BOJ policy has been the subject of debate among investors, weaker global growth, changes to the outlook for U.S. interest rate hikes and uncertainties in China and emerging markets have all been influential.

Kuroda, who is in the U.S. for spring meetings with the International Monetary Fund and talks with colleagues from Group of 20 nations, reaffirmed his belief that his monetary policy is having its intended effect and will in time spur inflation to a 2 percent target. The BOJ will add to stimulus without hesitation if needed, he said.

The governor also reiterated that the BOJ is not targeting currency markets with its policies.

It is not correct to consider the negative rate as a tax on banks or the use

of money, said Kuroda. The governor added that the policy will not cut profits at banks excessively, and ultimately will help them when it contributes to inflation in Japan.

Responding to concern that the BOJ may run out of bonds to buy to continue its monetary expansion program, Kuroda said he sees no obstacles now. Some 60 percent or 70 percent of Japanese government bonds are still potentially available for the central bank to purchase, he said.

The negative rate policy is fueling anxiety among households and companies and prolonging it may weaken financial institutions, Mitsubishi UFJ Financial Group President Nobuyuki Hirano said in a speech in Tokyo.

“Both households and businesses have become skeptical about the effectiveness of policy measures to address the current economic problems,” Hirano said, adding that Japan has been unable to bid deflation farewell.

Bank of Japan Executive Director Masayoshi Amamiya, speaking in Tokyo, said the BOJ still needs to closely monitor the impact of the negative rate on financial markets.

“It is important to consider whether there are any measures that should be taken by the market as a whole so that the market is able to adapt to changes and function properly,” he said. The BOJ wants to support discussions that contribute to the enhancement of the robustness of the financial markets, he said.

“I really don’t think that the introduction of the negative interest rate backfired or caused the yen to appreciate and stock markets to decline in Japan,” Kuroda said during a question and answer session at Columbia University in New York. “If anything, I can say that if we didn’t introduce the QQE with the negative interest rate, financial markets in Japan would have been even worse.”

The yen has rallied almost 11 percent since Jan. 29, when the BOJ announced it would charge financial institutions for a portion of the funds that they park at the central bank. The Topix share index has fallen 5 percent, while the banking index has plunged 15 percent. Although BOJ policy has been the subject of debate among investors, weaker global growth, changes to the outlook for U.S. interest rate hikes and uncertainties in China and emerging markets have all been influential.

Kuroda, who is in the U.S. for spring meetings with the International Monetary Fund and talks with colleagues from Group of 20 nations, reaffirmed his belief that his monetary policy is having its intended effect and will in time spur inflation to a 2 percent target. The BOJ will add to stimulus without hesitation if needed, he said.

The governor also reiterated that the BOJ is not targeting currency markets with its policies.

It is not correct to consider the negative rate as a tax on banks or the use

of money, said Kuroda. The governor added that the policy will not cut profits at banks excessively, and ultimately will help them when it contributes to inflation in Japan.

Responding to concern that the BOJ may run out of bonds to buy to continue its monetary expansion program, Kuroda said he sees no obstacles now. Some 60 percent or 70 percent of Japanese government bonds are still potentially available for the central bank to purchase, he said.

The negative rate policy is fueling anxiety among households and companies and prolonging it may weaken financial institutions, Mitsubishi UFJ Financial Group President Nobuyuki Hirano said in a speech in Tokyo.

“Both households and businesses have become skeptical about the effectiveness of policy measures to address the current economic problems,” Hirano said, adding that Japan has been unable to bid deflation farewell.

Bank of Japan Executive Director Masayoshi Amamiya, speaking in Tokyo, said the BOJ still needs to closely monitor the impact of the negative rate on financial markets.

“It is important to consider whether there are any measures that should be taken by the market as a whole so that the market is able to adapt to changes and function properly,” he said. The BOJ wants to support discussions that contribute to the enhancement of the robustness of the financial markets, he said.

- April 18, 2016

- Comment (0)

- Trackback(0)