Loading

Search

▼ 2 Years After Tax Hike, Buying Still Weak

- Category:Driving

By Sachio Nikaido / Yomiuri Shimbun Staff Writer

Friday marked two years since the consumption tax rate was increased from 5 percent to 8 percent, and individual consumption remains in the doldrums as the prices of many daily items rise while shoppers maintain a frugal mindset.

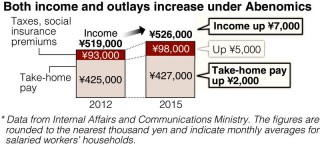

Although family incomes are tending to rise overall, take-home pay has barely grown due to increasing expenses such as higher social insurance premiums. Individual consumption holds the key to success for the Abenomics economic package of Prime Minister Shinzo Abe’s administration, but lackluster growth in consumption has prompted debate on whether the hike to 10 percent scheduled for April 2017 should be postponed.

Japan’s gross domestic product for the October-December quarter of 2015, the most recent period for which data is available, was an annualized ¥304.4 trillion. This was below the ¥305.8 trillion recorded in the April-June quarter of 2014, immediately after the tax rate was bumped up.

According to a survey by the Internal Affairs and Communications Ministry, the average monthly income for households where the main breadwinner is a salaried worker was ¥526,000 in 2015 — ¥7,000 higher than 2012, when the second Abe Cabinet was launched. This has been boosted by the government pushing for pay increases during spring labor negotiations.

Friday marked two years since the consumption tax rate was increased from 5 percent to 8 percent, and individual consumption remains in the doldrums as the prices of many daily items rise while shoppers maintain a frugal mindset.

Although family incomes are tending to rise overall, take-home pay has barely grown due to increasing expenses such as higher social insurance premiums. Individual consumption holds the key to success for the Abenomics economic package of Prime Minister Shinzo Abe’s administration, but lackluster growth in consumption has prompted debate on whether the hike to 10 percent scheduled for April 2017 should be postponed.

Japan’s gross domestic product for the October-December quarter of 2015, the most recent period for which data is available, was an annualized ¥304.4 trillion. This was below the ¥305.8 trillion recorded in the April-June quarter of 2014, immediately after the tax rate was bumped up.

According to a survey by the Internal Affairs and Communications Ministry, the average monthly income for households where the main breadwinner is a salaried worker was ¥526,000 in 2015 — ¥7,000 higher than 2012, when the second Abe Cabinet was launched. This has been boosted by the government pushing for pay increases during spring labor negotiations.

However, take-home pay has only increased by ¥2,000 due to an increase of ¥5,000 in social insurance premiums and income tax, which are deducted from a worker’s salary. With nursing care and pension premiums also trending upward, there is little tangible sense that household incomes are growing.

In addition to the consumption tax being lifted to 8 percent, the yen has weakened significantly over the past three years, which has pushed up prices of imported goods. Some estimates indicate the prices of daily goods are up 3 percent.

Many people aged 39 or younger have an entrenched mentality of holding off from making big purchases. “Compared with older generations, people in this age bracket have lower wages and feel uneasy about the future due to reasons such as problems with the pension system,” said Hideo Kumano at Dai-ichi Life Research Institute Inc.

‘Pre-engaged consumption’

The drop has been especially noticeable in items such as electrical appliances and cars, which consumers use for a long time. Demand for these items soared in the last-minute rush before the consumption tax was raised.

According to research firm GfK Japan, total domestic sales of household appliances in 2015 fell 5.7 percent from the previous year. Sales of new cars, including minicars, were down year-on-year for 14 consecutive months through February.

“We’ve really struggled to regain sales since the downturn, especially at stores in regional areas,” a representative of a major home appliance retail store said.

Before the April 2014 consumption tax hike, last-minute demand for items before prices increased was energized by tax breaks for fuel-efficient vehicles and the “eco-point” system for electrical appliances, creating what an economist called “pre-engaged consumption.” Two years on, demand from buying replacements for these items is not rising.

Decision time nearing

A trend of increases in basic wages continued in this year’s spring labor negotiations, but the rate of the increase was down from the previous year. And with the price of salt and many other commonly used items edging up, there is little room for optimism regarding the prospects of individual consumption.

According to Tatsushi Shikano at Mitsubishi UFJ Morgan Stanley Securities Co., increasing the consumption tax rate to 10 percent could push individual consumption down by 0.7 percent because the last-minute demand before the tax hike can only be considered a one-off and also shoppers hold off purchases due to the higher rate.

The preliminary GDP figure for the January-March quarter will be announced in mid-May. Abe is expected to decide whether to delay — once again — a hike in the consumption tax rate after carefully analyzing key economic indicators.

Many people aged 39 or younger have an entrenched mentality of holding off from making big purchases. “Compared with older generations, people in this age bracket have lower wages and feel uneasy about the future due to reasons such as problems with the pension system,” said Hideo Kumano at Dai-ichi Life Research Institute Inc.

‘Pre-engaged consumption’

The drop has been especially noticeable in items such as electrical appliances and cars, which consumers use for a long time. Demand for these items soared in the last-minute rush before the consumption tax was raised.

According to research firm GfK Japan, total domestic sales of household appliances in 2015 fell 5.7 percent from the previous year. Sales of new cars, including minicars, were down year-on-year for 14 consecutive months through February.

“We’ve really struggled to regain sales since the downturn, especially at stores in regional areas,” a representative of a major home appliance retail store said.

Before the April 2014 consumption tax hike, last-minute demand for items before prices increased was energized by tax breaks for fuel-efficient vehicles and the “eco-point” system for electrical appliances, creating what an economist called “pre-engaged consumption.” Two years on, demand from buying replacements for these items is not rising.

Decision time nearing

A trend of increases in basic wages continued in this year’s spring labor negotiations, but the rate of the increase was down from the previous year. And with the price of salt and many other commonly used items edging up, there is little room for optimism regarding the prospects of individual consumption.

According to Tatsushi Shikano at Mitsubishi UFJ Morgan Stanley Securities Co., increasing the consumption tax rate to 10 percent could push individual consumption down by 0.7 percent because the last-minute demand before the tax hike can only be considered a one-off and also shoppers hold off purchases due to the higher rate.

The preliminary GDP figure for the January-March quarter will be announced in mid-May. Abe is expected to decide whether to delay — once again — a hike in the consumption tax rate after carefully analyzing key economic indicators.

- April 2, 2016

- Comment (0)

- Trackback(0)