Loading

Search

▼ Coffee Market Brews Growth as Supply Hits Record High

- Category:Gourmet

The domestic coffee market is growing steadily and does not look like it will be grinding to a halt anytime soon.

Despite Japan’s shrinking population, the volume of coffee consumed at homes and major chain stores has reached a new high for the third straight year through 2015, and imports of green coffee beans have also been growing continuously.

The market was energized by the introduction of players from other industries, such as convenience stores that installed coffee machines on their counters. Established coffee makers, not wanting to be left behind, have also rolled out new products.

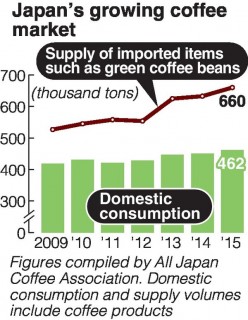

According to the All Japan Coffee Association, domestic coffee consumption reached about 462,000 tons in 2015, a record high and the fourth consecutive annual increase. The nation’s supply of coffee — a combination of imported green coffee beans and coffee powder, and domestic stocks — hit a record high of 660,000 tons in 2015. Between January and June this year, the volume of imported green beans was up by 9 percent from a year earlier.

Global demand for coffee is rising thanks to growth in emerging economies, and the international market for green beans is also trending upward. Supply in Japan greatly outstrips consumption because trading houses and others that import these goods are building up their stocks in anticipation of higher prices in the future.

Recent growth in the domestic coffee market was sparked by Seven-Eleven Japan Co.’s introduction of coffee machines near cash registers on store counters in 2013. The coffee was a hit and prompted other convenience store chains to follow suit.

In recent years, there has been an increase in so-called third-wave coffee specialty stores that are very particular about where their beans are grown and serve hand-drip coffee, a process that involves painstakingly making each cup of coffee individually. The circle of coffee fans is growing.

Key Coffee Inc., an established major player in Japan’s coffee industry, aims to boost demand among generations that fondly called coffee shops “saten” (an abbreviation of “kissaten,” the Japanese word for coffee shop).

Despite Japan’s shrinking population, the volume of coffee consumed at homes and major chain stores has reached a new high for the third straight year through 2015, and imports of green coffee beans have also been growing continuously.

The market was energized by the introduction of players from other industries, such as convenience stores that installed coffee machines on their counters. Established coffee makers, not wanting to be left behind, have also rolled out new products.

According to the All Japan Coffee Association, domestic coffee consumption reached about 462,000 tons in 2015, a record high and the fourth consecutive annual increase. The nation’s supply of coffee — a combination of imported green coffee beans and coffee powder, and domestic stocks — hit a record high of 660,000 tons in 2015. Between January and June this year, the volume of imported green beans was up by 9 percent from a year earlier.

Global demand for coffee is rising thanks to growth in emerging economies, and the international market for green beans is also trending upward. Supply in Japan greatly outstrips consumption because trading houses and others that import these goods are building up their stocks in anticipation of higher prices in the future.

Recent growth in the domestic coffee market was sparked by Seven-Eleven Japan Co.’s introduction of coffee machines near cash registers on store counters in 2013. The coffee was a hit and prompted other convenience store chains to follow suit.

In recent years, there has been an increase in so-called third-wave coffee specialty stores that are very particular about where their beans are grown and serve hand-drip coffee, a process that involves painstakingly making each cup of coffee individually. The circle of coffee fans is growing.

Key Coffee Inc., an established major player in Japan’s coffee industry, aims to boost demand among generations that fondly called coffee shops “saten” (an abbreviation of “kissaten,” the Japanese word for coffee shop).

On Sept. 1, Key Coffee will start selling ground coffee made from 100 percent Arabica beans, including high-quality Toarco Toraja beans handpicked on a plantation in Indonesia. It hopes this will become a major product in its lineup.

“Our main target is customers in their 40s or older, who are particular about the coffee they drink at home,” a Key Coffee official said.

The instant coffee that Ajinomoto General Foods, Inc. will put on the market on Aug. 25 comes in individually packaged powder sticks. According to the company, it has a deep flavor like coffee served in specialty stores.

Japan’s annual consumption of coffee per capita is about 300 cups, which is the 14th-highest in the world. However, many observers believe the market will continue to grow.

“There’s still room to expand,” an official at a major coffee company said.

“Our main target is customers in their 40s or older, who are particular about the coffee they drink at home,” a Key Coffee official said.

The instant coffee that Ajinomoto General Foods, Inc. will put on the market on Aug. 25 comes in individually packaged powder sticks. According to the company, it has a deep flavor like coffee served in specialty stores.

Japan’s annual consumption of coffee per capita is about 300 cups, which is the 14th-highest in the world. However, many observers believe the market will continue to grow.

“There’s still room to expand,” an official at a major coffee company said.

- August 13, 2016

- Comment (0)

- Trackback(0)