Loading

Search

▼ M&As By Japan Companies Top ¥20 tril. in 1st Half

- Category:Other

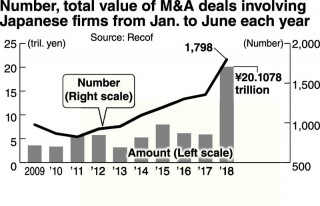

Japanese companies have been increasingly engaged in mergers and acquisitions, with the total value of such deals exceeding ¥20 trillion in the first half of this year — the first time ever for the January-June period.

Backed by strong business performances and the nation’s ultralow interest rates, many Japanese companies have aimed for growth by acquiring overseas companies.

According to a survey by M&A advisory company Recof Corp., the value of such deals involving Japanese companies, including capital participation, totaled more than ¥20.1078 trillion on a reported basis from January to June. This is the highest amount since the survey began in 1985, a period that includes the bubble economy.

The figure was 3.4 times that of the same period last year, an increase of more than ¥14 trillion. The number of deals stood at 1,798, up 30 percent from a year earlier and also a record high.

The total value of acquisitions of foreign companies by Japanese companies amounted to ¥11.7501 trillion, already more than the previously record-high annual total of ¥11.2176 trillion in 2015. The growth has been led by Takeda Pharmaceutical Co., which announced its acquisition of leading Irish drug maker Shire PLC in May.

The nation’s largest pharmaceutical company will pay nearly ¥7 trillion for the deal, which is expected to be the highest price ever paid by a Japanese company to acquire a foreign company.

Backed by strong business performances and the nation’s ultralow interest rates, many Japanese companies have aimed for growth by acquiring overseas companies.

According to a survey by M&A advisory company Recof Corp., the value of such deals involving Japanese companies, including capital participation, totaled more than ¥20.1078 trillion on a reported basis from January to June. This is the highest amount since the survey began in 1985, a period that includes the bubble economy.

The figure was 3.4 times that of the same period last year, an increase of more than ¥14 trillion. The number of deals stood at 1,798, up 30 percent from a year earlier and also a record high.

The total value of acquisitions of foreign companies by Japanese companies amounted to ¥11.7501 trillion, already more than the previously record-high annual total of ¥11.2176 trillion in 2015. The growth has been led by Takeda Pharmaceutical Co., which announced its acquisition of leading Irish drug maker Shire PLC in May.

The nation’s largest pharmaceutical company will pay nearly ¥7 trillion for the deal, which is expected to be the highest price ever paid by a Japanese company to acquire a foreign company.

At a time when the global pharmaceutical market is dominated by giants such as Pfizer Inc. and Roche Holding AG, Takeda has decided to acquire an overseas company that is seen as promising in a bid to survive the competition.

SoftBank Group Corp., which has acquired a major British semiconductor company for over ¥3 trillion, continues to show its willingness to engage in M&A deals targeting overseas companies. In January, SoftBank acquired shares of Uber Technologies Inc., becoming the largest shareholder in the fast-growing ride-sharing platform.

Such M&A deals have been driven by a strong sense of crisis among business executives, with a senior official at a foreign securities company saying: “The domestic market is shrinking, so they know they can’t survive if they do business only in Japan.”

Money for investment

The Bank of Japan’s massive easing policy has made it easier for companies to raise funds. For the Shire acquisition, Takeda will pay over ¥3 trillion in cash, while planning to cover part of the remaining cost with loans from Japanese and other banks.

Strong business performances of domestic companies have also given a boost.

“Many Japanese companies have increasing amounts of internal reserves, and are trying to figure out how to invest them,” said Takeshi Minami, chief economist at Norinchukin Research Institute Co. “The trend in which companies will use their internal reserves for acquisitions or making capital investment will likely continue.”

According to a Finance Ministry survey, internal reserves by Japanese companies have topped ¥400 trillion, one of the highest figures on record. There are growing calls for companies to use their increasing internal reserves for investment.

The number of acquisitions of domestic companies by other Japanese firms totaled 1,338 in the first half of 2018, up 39.4 percent from a year earlier. Life insurers and other institutional investors, which commonly become the major shareholders of target companies through M&As, often call for the companies to review unprofitable businesses.

On the other hand, it is not easy for Japanese companies to deal with overseas companies they have acquired. Toshiba Corp. made a huge investment to acquire Westinghouse Electric Co., but it eventually went into bankruptcy after incurring losses mainly because of delays in the U.S.

company’s projects to build nuclear power plants. This case illustrates how corporate acquisitions that invest a huge amount of money in anticipation of the company’s growth can also pose a great risk.

SoftBank Group Corp., which has acquired a major British semiconductor company for over ¥3 trillion, continues to show its willingness to engage in M&A deals targeting overseas companies. In January, SoftBank acquired shares of Uber Technologies Inc., becoming the largest shareholder in the fast-growing ride-sharing platform.

Such M&A deals have been driven by a strong sense of crisis among business executives, with a senior official at a foreign securities company saying: “The domestic market is shrinking, so they know they can’t survive if they do business only in Japan.”

Money for investment

The Bank of Japan’s massive easing policy has made it easier for companies to raise funds. For the Shire acquisition, Takeda will pay over ¥3 trillion in cash, while planning to cover part of the remaining cost with loans from Japanese and other banks.

Strong business performances of domestic companies have also given a boost.

“Many Japanese companies have increasing amounts of internal reserves, and are trying to figure out how to invest them,” said Takeshi Minami, chief economist at Norinchukin Research Institute Co. “The trend in which companies will use their internal reserves for acquisitions or making capital investment will likely continue.”

According to a Finance Ministry survey, internal reserves by Japanese companies have topped ¥400 trillion, one of the highest figures on record. There are growing calls for companies to use their increasing internal reserves for investment.

The number of acquisitions of domestic companies by other Japanese firms totaled 1,338 in the first half of 2018, up 39.4 percent from a year earlier. Life insurers and other institutional investors, which commonly become the major shareholders of target companies through M&As, often call for the companies to review unprofitable businesses.

On the other hand, it is not easy for Japanese companies to deal with overseas companies they have acquired. Toshiba Corp. made a huge investment to acquire Westinghouse Electric Co., but it eventually went into bankruptcy after incurring losses mainly because of delays in the U.S.

company’s projects to build nuclear power plants. This case illustrates how corporate acquisitions that invest a huge amount of money in anticipation of the company’s growth can also pose a great risk.

- August 10, 2018

- Comment (0)

- Trackback(0)