Loading

Search

▼ JOGMEC Suffers ¥160 bil. In Losses

- Category:Event

Twenty-three natural resource exploration and development companies, in which a government-affiliated body has invested, have given up on their development plans in the initial stage, according to a survey conducted by the Board of Audit.

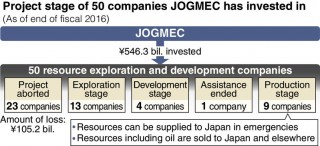

The Japan Oil, Gas and Metals National Corporation (JOGMEC), which is an independent administrative agency under the jurisdiction of the Economy, Trade and Industry Ministry, had invested in a total of 50 companies by the end of fiscal 2016.

The agency had suffered losses totaling about ¥159.5 billion as of the end of fiscal 2016. There are also two gas fields for which there are no prospects of turning them into a business, despite the success of the development. The agency is likely to be forced to review its strategy.

JOGMEC has supported private companies that develop natural resources, such as rare metals, in addition to oil and natural gas, aiming at ensuring a stable energy supply. It was established in 2004 to take over both parts of the operations of the Japan National Oil Corporation (JNOC) and the Metal Mining Agency of Japan (MMAJ). The agency has also actively invested in high-risk projects.

This is the first time for the Board of Audit to conduct an overall investigation into the agency’s balance. According to the board, the agency paid a total of about ¥550.8 billion, including about ¥546.3 billion that has been invested in 50 private companies that develop oil fields and gas fields overseas from fiscal 2004 to 2016.

Of them, 23 companies in which the agency has invested a total of about ¥105.3 billion gave up development because the reserves of natural gas and other resources were less than expected or for other reasons. As a result of the 23 companies ending or liquidating their business, the agency’s losses totaled about ¥105.2 billion.

The agency has suffered not only about a ¥122.6 billion valuation loss in the middle stage of prospecting and developing, but other losses as well, including about ¥1.8 billion in a foreign exchange loss, which was due to the change in the exchange rate between the acquisition and sale of a stake in a Canadian development company, which the agency bought for about ¥21 billion.

There are two companies that, despite succeeding in developing gas fields, cannot turn them into businesses because a liquefaction facility and pipeline have not been constructed. The facilities were scheduled to be built by other companies, with which the agency was not involved.

If its commercialization succeeds, the agency will be paid dividends based on profits from the sale of oil, gas and others, and will get preferential supply in the event of an emergency. So far, nine companies have succeeded in turning their developments into a business. However, the agency’s revenue, including dividends, was only about ¥95.1 billion, and its accumulated losses totaled ¥159.5 billion.

On the other hand, the government has also financed the agency from a special account for energy measures. About ¥48.9 billion remained as of the end of fiscal 2016, which had been held by the agency. The agency did not spend this money because it gave up on or changed projects, despite its budget request being based in its market forecasts.

The Board of Audit is calling on the agency to gather information on oil-producing countries and understand the actual needs of funding for developing companies. The agency official said, “We have invested in projects with risks, and loss has been factored into the ongoing process. We’d like people to take the long-range view of 20 or 30 years.”

- July 28, 2018

- Comment (0)

- Trackback(0)