Loading

Search

▼ Suzuki Much to Gain in Toyota Tie-up

- Category:Driving

The start of tie-up discussions between Toyota Motor Corp. and Suzuki Motor Corp. could lead to a partnership with significant benefits for both automakers — especially Suzuki.

At a time when massive investment is essential for developing self-driving technologies and eco-friendly vehicles, siding with the world’s largest automaker makes sense for Suzuki, which would struggle to survive on its own.

Toyota aims to push ahead with global standardization in the industry by having other companies use its technologies.

“There is no change to our resolve to operate as an independent company,” Suzuki Chairman Osamu Suzuki said at a joint press conference in Tokyo on Wednesday. “However, our future would be uncertain if we only continued to refine our own automobile technology.”

Suzuki’s decision to begin talks with Toyota was spurred by this point. Suzuki, whose strength lies in producing cheap mini-vehicles, has hitherto focused on reducing costs to stay afloat in the auto market.

Suzuki’s development of technologies for self-driving vehicles, and for enabling vehicles to meet tightening environmental regulations imposed in Europe and the United States, pales in comparison to other carmakers. Its research and development budget for the fiscal year ending March 2016 was ¥131 billion — just one-eighth of the amount Toyota spent on research and development.

With one year passing since Suzuki’s tie-up with German automaker Volkswagen AG ended in September 2015, Suzuki apparently decided it was time to lean toward the mighty Toyota.

At the press conference, Toyota President Akio Toyoda said his company agreed to launch negotiations because “working with other companies will become an important element as we make friends to lead standardization in the industry.”

Toyota seems prepared to build a new group to increase the number of automakers whose vehicles feature its cutting-edge technology, including self-driving vehicles.

Toyoda, however, insisted the talks were at a preliminary stage and did not go into detail about a possible tie-up. “We’re still at the stage of meeting each other with a view to a prospective relationship,” he said. “I want to think about what we can do together.”

When asked whether it was possible that Suzuki would join the Toyota group, Suzuki said, “It’s too soon to be asking that question, but we’ll carefully consider this issue.”

Because Suzuki’s tie-up with VW soured as it became irritated by the

German maker treating it like a subsidiary, Toyota aims to take time to build ties with Suzuki to prevent a repeat.

Suzuki and Daihatsu Motor Co., which is a Toyota subsidiary, hold a combined share of about 60 percent of the Japanese mini-vehicle market. If both carmakers were in the Toyota group, it could infringe on the Antimonopoly Law.

Toyoda indicated careful consideration would be needed on this matter. “We’ll move ahead in line with legal regulations,” he said. “If necessary, we’ll consult with the Fair Trade Commission and other authorities.”

Realignment speeding up

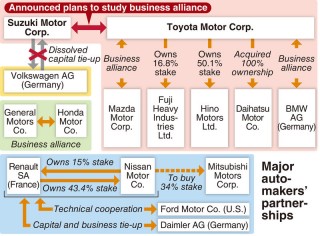

The auto industry is facing a turning point. Due to the high cost of going it alone as competition intensifies in the development of driverless vehicle technology and of meeting steadily strengthened environmental regulations, a fresh flurry of mergers and realignments is spreading.

Nissan Motor Co. is set to complete bringing Mitsubishi Motors Corp. under its umbrella by the end of October. Sparked by revelations in April that Mitsubishi had been falsifying fuel efficiency data for its vehicles, Nissan’s capital alliance indicates that the automaker will lead the rebuilding of Mitsubishi.

Moreover, Nissan aims to bring in Mitsubishi’s electric vehicle technologies, such as its plug-in hybrid vehicles. Nissan, which also has a capital tie-up with French automaker Renault SA, wants to create synergies such as sharing production bases and procurement routes.

Honda Motor Co., which had walked its own path, launched joint development of fuel cell systems with U.S. carmaker General Motors Co. in 2013.

If the Toyota-Suzuki tie-up becomes a reality, Toyota’s presence in the domestic market would increase further. Toyoda indicated tie-ups with other automakers were still possible. “We would like to always keep our doors open for new partnership opportunities,” he said.

The Toyota-Suzuki talks have alarmed some domestic observers. “It could strengthen Toyota’s position as the only giant in an industry with many smaller rivals,” said a source at a Japanese automaker.

Toyota itself is scrambling to catch up with carmakers from Europe and the United States in setting global standards for technology development.

Just how deep a tie-up Toyota can form with Suzuki will be a touchstone for how far it can expand its circle of partners.Speech

Toyoda, however, insisted the talks were at a preliminary stage and did not go into detail about a possible tie-up. “We’re still at the stage of meeting each other with a view to a prospective relationship,” he said. “I want to think about what we can do together.”

When asked whether it was possible that Suzuki would join the Toyota group, Suzuki said, “It’s too soon to be asking that question, but we’ll carefully consider this issue.”

Because Suzuki’s tie-up with VW soured as it became irritated by the

German maker treating it like a subsidiary, Toyota aims to take time to build ties with Suzuki to prevent a repeat.

Suzuki and Daihatsu Motor Co., which is a Toyota subsidiary, hold a combined share of about 60 percent of the Japanese mini-vehicle market. If both carmakers were in the Toyota group, it could infringe on the Antimonopoly Law.

Toyoda indicated careful consideration would be needed on this matter. “We’ll move ahead in line with legal regulations,” he said. “If necessary, we’ll consult with the Fair Trade Commission and other authorities.”

Realignment speeding up

The auto industry is facing a turning point. Due to the high cost of going it alone as competition intensifies in the development of driverless vehicle technology and of meeting steadily strengthened environmental regulations, a fresh flurry of mergers and realignments is spreading.

Nissan Motor Co. is set to complete bringing Mitsubishi Motors Corp. under its umbrella by the end of October. Sparked by revelations in April that Mitsubishi had been falsifying fuel efficiency data for its vehicles, Nissan’s capital alliance indicates that the automaker will lead the rebuilding of Mitsubishi.

Moreover, Nissan aims to bring in Mitsubishi’s electric vehicle technologies, such as its plug-in hybrid vehicles. Nissan, which also has a capital tie-up with French automaker Renault SA, wants to create synergies such as sharing production bases and procurement routes.

Honda Motor Co., which had walked its own path, launched joint development of fuel cell systems with U.S. carmaker General Motors Co. in 2013.

If the Toyota-Suzuki tie-up becomes a reality, Toyota’s presence in the domestic market would increase further. Toyoda indicated tie-ups with other automakers were still possible. “We would like to always keep our doors open for new partnership opportunities,” he said.

The Toyota-Suzuki talks have alarmed some domestic observers. “It could strengthen Toyota’s position as the only giant in an industry with many smaller rivals,” said a source at a Japanese automaker.

Toyota itself is scrambling to catch up with carmakers from Europe and the United States in setting global standards for technology development.

Just how deep a tie-up Toyota can form with Suzuki will be a touchstone for how far it can expand its circle of partners.Speech

- October 15, 2016

- Comment (0)

- Trackback(0)