Loading

Search

▼ Toshiba Chip Unit Deal Hits Roadblock / Hynix Searching For a Way to Gain Say Over Management

- Category:Event

Toshiba Corp. is struggling to finalize negotiations to sell off its memory chip unit, Toshiba Memory Corp.

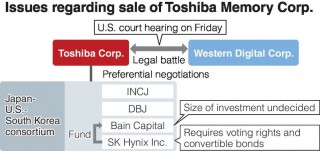

The sale is on shaky footing because SK Hynix Inc., a major South Korean chipmaker that is part of a Japan-U.S.-South Korean consortium Toshiba chose as the preferred bidder, is now seeking to gain a say in management.

Another barrier is the legal battle with Western Digital Corp., a U.S. company that jointly produces memory chips with Toshiba and opposes the sale.

The Innovation Network Corporation of Japan (INCJ), a public-private fund, and the government-backed Development Bank of Japan Inc. are also part of the multinational consortium. The Japanese side has management control in the current framework. Bain Capital, a fund based in the United States, and SK Hynix are also part of the deal.

Toshiba hoped to have a final agreement in place by its general shareholders meeting on June 28.

SK Hynix is also in the memory business, so it had been predicted to take an indirect role in the consortium by simply lending capital to Bain for the acquisition. Toshiba President Satoshi Tsunakawa has said SK Hynix “has no voting rights and will not participate in management.”

However, sources said SK Hynix has recently been seeking voting rights and searching for a way to provide funding, such as through convertible bonds that could be exchanged for stocks in the future.

Bain has yet to finalize the size of its investment because of worries it could be sued by Western Digital for improperly interfering in its contract with Toshiba.

The sale is on shaky footing because SK Hynix Inc., a major South Korean chipmaker that is part of a Japan-U.S.-South Korean consortium Toshiba chose as the preferred bidder, is now seeking to gain a say in management.

Another barrier is the legal battle with Western Digital Corp., a U.S. company that jointly produces memory chips with Toshiba and opposes the sale.

The Innovation Network Corporation of Japan (INCJ), a public-private fund, and the government-backed Development Bank of Japan Inc. are also part of the multinational consortium. The Japanese side has management control in the current framework. Bain Capital, a fund based in the United States, and SK Hynix are also part of the deal.

Toshiba hoped to have a final agreement in place by its general shareholders meeting on June 28.

SK Hynix is also in the memory business, so it had been predicted to take an indirect role in the consortium by simply lending capital to Bain for the acquisition. Toshiba President Satoshi Tsunakawa has said SK Hynix “has no voting rights and will not participate in management.”

However, sources said SK Hynix has recently been seeking voting rights and searching for a way to provide funding, such as through convertible bonds that could be exchanged for stocks in the future.

Bain has yet to finalize the size of its investment because of worries it could be sued by Western Digital for improperly interfering in its contract with Toshiba.

If Bain were to reduce its investment and SK Hynix stepped in to fill the gap, the latter could seek some part in management in return.

However, if such a role were granted, the deal could face drawn-out screenings by antitrust authorities in various countries because the South Korean firm already holds a share of the memory market.

Toshiba wants to complete the sale of the chip unit by the end of March so it can avoid being delisted for having liabilities in excess of assets, but this scenario could be upset.

Toshiba and Western Digital’s inability to resolve their conflict is also affecting the final agreement.

Western Digital has requested a California court temporarily halt the proceedings of the sale. The two sides are scheduled to present their cases at a hearing on Friday, meaning a conclusion may be close.

The consortium could fall apart if the sale is temporarily halted, because INCJ’s investment is predicated on reaching a resolution with Western Digital.

Toshiba wants to quickly reach a final agreement, but a source said with a sense of crisis, “If things aren’t decided by August, other options must be considered.”

However, if such a role were granted, the deal could face drawn-out screenings by antitrust authorities in various countries because the South Korean firm already holds a share of the memory market.

Toshiba wants to complete the sale of the chip unit by the end of March so it can avoid being delisted for having liabilities in excess of assets, but this scenario could be upset.

Toshiba and Western Digital’s inability to resolve their conflict is also affecting the final agreement.

Western Digital has requested a California court temporarily halt the proceedings of the sale. The two sides are scheduled to present their cases at a hearing on Friday, meaning a conclusion may be close.

The consortium could fall apart if the sale is temporarily halted, because INCJ’s investment is predicated on reaching a resolution with Western Digital.

Toshiba wants to quickly reach a final agreement, but a source said with a sense of crisis, “If things aren’t decided by August, other options must be considered.”

- July 12, 2017

- Comment (0)

- Trackback(0)