Loading

Search

▼ ‘Monster Strike’ Claws To Top Of Mobile Game Market

- Category:Other

By So Sasaki and Daisuke Ichikawa / Yomiuri Shimbun Staff

WritersMixi, Inc.’s game “Monster Strike” has gained a large lead over its competitors in the smartphone game market. While the trailblazing “Puzzle & Dragons” by GungHo Online Entertainment loses momentum, the earnings of “Monster Strike” from in-game user purchases continue to grow.

“I think we can offer a newer way to play [with ‘Monster Strike’],” said Mixi President Hiroki Morita at a press conference on Feb. 5, during which the company’s consolidated financial statements for the April to December 2015 period were presented.

Morita was confident that the game would maintain its popularity. Sales were forecast to reach ¥205 billion for fiscal 2015 ending March, an 80 percent increase over the previous period and a record high.

“Monster Strike” was first made available for download in September 2013. Its popularity derives from its simple controls and the ability to play with up to four players. It has also expanded into overseas markets such as Taiwan and Hong Kong, and the worldwide number of users has exceeded 30 million.

On the other hand, “Puzzle & Dragons” has seen its momentum begin to slip away, with sales totaling ¥154.3 billion, according to GungHo’s consolidated financial statements for the business year that ended December 2015 — an 11 percent drop from the previous period. Their strategy of basing their business on only games is being put to the test.

WritersMixi, Inc.’s game “Monster Strike” has gained a large lead over its competitors in the smartphone game market. While the trailblazing “Puzzle & Dragons” by GungHo Online Entertainment loses momentum, the earnings of “Monster Strike” from in-game user purchases continue to grow.

“I think we can offer a newer way to play [with ‘Monster Strike’],” said Mixi President Hiroki Morita at a press conference on Feb. 5, during which the company’s consolidated financial statements for the April to December 2015 period were presented.

Morita was confident that the game would maintain its popularity. Sales were forecast to reach ¥205 billion for fiscal 2015 ending March, an 80 percent increase over the previous period and a record high.

“Monster Strike” was first made available for download in September 2013. Its popularity derives from its simple controls and the ability to play with up to four players. It has also expanded into overseas markets such as Taiwan and Hong Kong, and the worldwide number of users has exceeded 30 million.

On the other hand, “Puzzle & Dragons” has seen its momentum begin to slip away, with sales totaling ¥154.3 billion, according to GungHo’s consolidated financial statements for the business year that ended December 2015 — an 11 percent drop from the previous period. Their strategy of basing their business on only games is being put to the test.

Keeping players mesmerized

The nature of the cell phone game marketplace is constantly shifting. During the age of so-called garakei cell phones — popular in Japan before the rise of smartphones — DeNA Co.’s “Kaito Royale” and Gree, Inc.’s “Fishing Star” were notable hits.

However, neither company has made an appearance in the smartphone game arena, and both have recently been looking at diversifying their businesses as a means to survive.

“Monster Strike” has been able to maintain its popularity because it continues to introduce features to prevent users from losing interest.

Yasuo Imanaka, an analyst at Rakuten Securities, Inc., said: “Since you can play together with your friends, it takes longer to get bored. There is also a growing trend of parents playing the game with their kids.”

Last autumn, characters from the popular anime “Lupin the Third” appeared in the game for a limited time.

Although Mixi operated at a loss in fiscal 2013 due to the decline of its social networking service, the firm has revived itself with the overwhelming success of “Monster Strike.”

However, with 90 percent of its sales income being related to that game, it may be relying too much on an unbalanced, “one-legged” business structure. The ebb and flow in the industry is intense, and upcoming developments will be watched closely.

Competition fierce

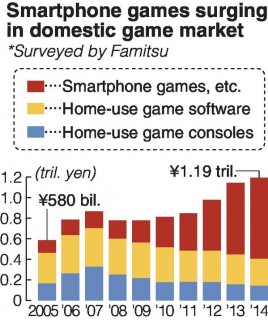

In recent years, the domestic game market has been characterized by sluggishness in the conventional home-use game console segment on the one hand, and significant growth in the smartphone segment on the other.

According to the video game news publication Famitsu, the market reached a record size of about ¥1.19 trillion in 2014. Smartphone games made up over half of this amount at ¥715.4 billion, an 18 percent increase compared to the previous year.

The popularization of game consoles began with the release of Nintendo Co.’s Family Computer in 1983. It was a highly capable machine for the time, with total worldwide sales surpassing 60 million units.

The capabilities of console and portable game systems sharply increased starting in the 1990s, and games today feature high-definition realistic graphics.

The increasing power of game systems forced makers to significantly increase development costs. Games that failed to sell came to have a bigger impact on bottom lines.

In comparison, development costs for smartphone games are low, and hits have the potential to bring massive profits. Portability, which enables people to casually play smartphone games wherever they happen to be, has also led to an increase in users who were not game fans in the past.

However, the capabilities of smartphones have been increasing dramatically, and development costs for smartphone games could increase in the future.

Moreover, a number of smartphone games besides “Monster Strike” and “Puzzle & Dragons” have become hits, including Colopl, Inc.’s “Shironeko Project.” Significant sums must be expended on advertising to differentiate games and increase their visibility. As the market expands, the competitive environment is becoming more intense.

- March 14, 2016

- Comment (0)

- Trackback(0)