Loading

Search

▼ Two nations lead Southeast Asia's motorization

- Category:Other

ASIA NIKKEI

For automakers, Southeast Asia means Indonesia and Thailand.

Impending Thai auto subsidies have manufacturers from across the globe scrambling to set up shop. Indonesia, meanwhile, is a huge market with plenty of room to grow.

The entire region has promise. But capturing a piece of these two markets could allow an automaker to lay the foundations for future regional expansion.

"Since the Mazda 2 [called the Demio in some markets] is a highly competitive model globally," said Yuji Nakamine on Nov. 6, "it will make a big contribution to the growth of the Thai automobile industry as an export model." Nakamine, senior managing executive officer of Mazda Motor, was at a ceremony in Thailand marking the beginning of production of the car there.

Initial production of cars for export to Australia began in mid-September at Auto Alliance (Thailand), a 50-50 joint venture with U.S. automaker Ford Motor in the southeastern province of Rayong.

To begin mass production, Mazda took over passenger car production lines from Ford with a view to raising annual output capacity to 120,000 units, up from 50,000. Sales in Thailand and neighboring countries are due to begin early next year. Total investment costs in the Mazda 2 factory were 12.6 billion baht ($383 million). "We are investing so big because we aim to build Thailand into our global export hub," Nakamine said.

Helping hand

The Mazda 2 will be eligible for tax benefits under Thailand's program to promote fuel-efficient, low-cost small cars. The companies that benefited from the first phase of the government program, which began in 2007 and ran through 2012, were Toyota Motor, Honda Motor, Nissan Motor, Mitsubishi Motors and Suzuki Motor -- all Japanese. Nine models, including Nissan's March, which in March 2010 began rolling off production lines, achieved combined sales of 500,000 units. The cumulative total of cars that were built, including exported vehicles, came to more than 1 million.

Nissan shifted production of the March from Japan to Thailand during the subsidy program. It has remained there since, and the car is exported from the Southeast Asian nation to the rest of the world, including Nissan's home market of Japan. It was the first time for Nissan to produce a major model overseas for export back home. Critics worried whether Thai workers could turn out quality cars. But no longer. The export base has been a success.

Among Japanese automakers with production bases in Thailand, Mazda was the only one to miss out on the first round of subsidies. So when the government unveiled Phase 2 of its program for eco-friendly cars, Mazda was determined to be the first to get preferential treatment.

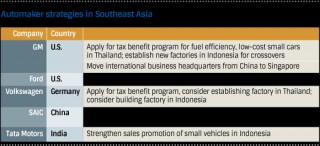

Japanese automakers have company this time round. General Motors and Ford Motor of the U.S., Gremany's Volkswagen and SAIC Motor-CP, a joint venture between Shanghai Automotive Industry and Thai conglomerate Charoen Pokphand Group, are all expected to apply for tax breaks.

Subsidies will be available for cars with gas engines of 1.3 liters or less, and those with diesel engines of up to 1.5 liters. The cars also have to get a fuel efficiency of at least 23km per liter of fuel to qualify.

Manufacturers are expected to invest at least 6.5 billion baht in facilities for subsidy-compliant cars. They must also ramp up output to at least 100,000 units annually within four years. If all conditions are met, the government will reduce or eliminate such charges as corporate tax, import tariffs on facilities and components, and excise tax.

The five Japanese automakers that qualified for the first round of benefits positioned Thailand as a launchpad for exporting low-priced small vehicles worldwide.

Ford and GM are expected to do the same when the next phase kicks in. GM has a Thai plant, built in 2000, that is capable of turning out 130,000 vehicles a year. Outside of its joint venture with Mazda, Ford has a plant that began operations in 2012 and can build 150,000 vehicles a year. SAIC Motor-CP opened a factory in June with an annual capacity of 50,000 vehicles. It aims to build one more facility, which will add another 200,000 vehicles to capacity. Volkswagen does not have factories in Thailand but is considering setting up a plant to produce eco-friendly cars there.

Glut feeling

Thailand's auto market may soon have an overproduction problem. Still, manufacturers are undeterred; Southeast Asia is one of the world's most promising growth markets.

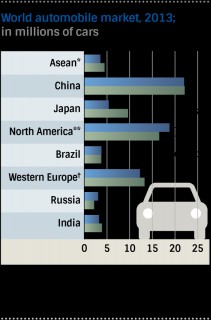

Six major Southeast Asian nations -- Thailand, Indonesia, Malaysia, the Philippines, Vietnam and Singapore -- saw combined new car sales rise 70% over the five years through 2013, to 3.56 million vehicles. The combined market is larger than that of Russia, which in 2013 had sales of 3.04 million vehicles, India's 3.24 million, and close to Brazil's 3.77 million.

The Association of Southeast Asian Nations "has a population of 600 million people and a growing middle class, and very low vehicle density," said Matt Bradley, president of Ford Asean. "That will make Asean one of the largest buying populations in the world." Sometime in the next five years, he added, Asean will hit 5 million sales annually.

Two characteristics define the Southeast Asian auto market: its importance for meeting demand at home and abroad, and the dominance of Japanese companies.

Thailand is home not only to automakers, but also to a number of parts and materials suppliers, reflecting its growing importance as an export hub. Indonesia, meanwhile, with a population of 250 million, has a great deal of domestic demand to satisfy. The two nations make up more than 70% of the regional market.

Japanese vehicle sales in Asean have outstripped regional market growth. Japanese producers have a combined 89% share of Thailand's auto market and 95% of Indonesia's. European, U.S. and other automakers need to figure out how to take share from Japanese manufacuturers.

Non-Japanese companies are working on doing just that. In Indonesia, which is set to overtake Thailand to become Southeast Asia's top auto market this year, GM has constructed a plant with an output capacity of 40,000 vehicles a year at a cost of $150 million. Production at this plant, in Bekasi, on the outskirts of Jakarta, commenced in mid-2013. It turns out a family-friendly, small crossover utility vehicle, the Chevrolet Spin. The price of the seven-seat vehicle starts at 150 million rupiah ($12,300), about the same price as the mainstay model of Toyota's Avanza, Indonesia's top-seller.

Ford earlier this year launched a small SUV, the EcoSport, in addition to its popular compact Fiesta in Indonesia. The EcoSport is designed to appeal to young consumers and sells for 200 million rupiah to 300 million rupiah.

Tata Motors, which in 2012 formed a subsidiary in Indonesia, last year released the small hatchback Vista, SUV Safari Storme and crossover Aria. At the Indonesia International Motor Show in Jakarta in September, the Indian company displayed its Zest sedan, which had just hit the Indian market. Tata is considering selling the car in Indonesia.

"We will continue to introduce new models and create a new market," said Biswadev Sengupta, president director of Tata Motors Distribusi Indonesia.

Extra space

Statistics on car ownership highlight the growth potential of the Thai and Indonesian markets. In Thailand, one out of five people owns a car; in Indonesia, one in 60. By contrast, there is one car per 1.3 people in the U.S. and one per 1.7 in Japan.

Moreover, Asean plans to create a single market in late 2015. This should add further impetus to auto and auto parts exports within the region, and facilitate production and marketing. The Asean Economic Community is expected to simplify procedures for foreign companies wanting to set up shop in countries in the region.

Despite the promise, automakers face significant challenges. Volkswagen, which had planned to break ground on a plant in Indonesia earlier this year, put off the move until 2015 or later as the rupiah depreciated. Non-Japanese companies have also yet to create robust sales and service networks, which will likely limit their reach for potential customers.

- November 18, 2014

- Comment (0)

- Trackback(0)