Loading

Search

▼ Markets Start To Bounce Back After Steep Losses

- Category:Other

Shares in the US enjoyed a late-afternoon boost on Tuesday as a rise in oil prices helped markets to recover some ground one day after the biggest falls since the 2008 financial crisis.

The three main US indexes closed more than 4.9% higher. Earlier, shares in Europe slipped into negative territory, despite initial bounce-backs.

London's FTSE 100 ended almost flat, after a 7.7% drop the day before.

In France and Germany, the main indexes dropped more than 1.4%.

Markets were battered on Monday in reaction to the threat of an oil price war between Russia and Saudi Arabia.

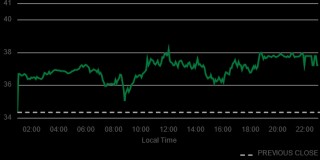

But after falling as much as 30% on Monday, oil prices rebounded slightly, with Brent crude more than 8% higher.

The three main US indexes closed more than 4.9% higher. Earlier, shares in Europe slipped into negative territory, despite initial bounce-backs.

London's FTSE 100 ended almost flat, after a 7.7% drop the day before.

In France and Germany, the main indexes dropped more than 1.4%.

Markets were battered on Monday in reaction to the threat of an oil price war between Russia and Saudi Arabia.

But after falling as much as 30% on Monday, oil prices rebounded slightly, with Brent crude more than 8% higher.

Analysts said US markets were helped along by promises from the White House to take steps to protect the US economy against the impact of the coronavirus outbreak.

"Obviously there has been concern voiced in the market that this is not being contained and more needs to be done," said William Foster, vice president and lead US analyst for Moody's Investors Service.

"Now we're starting to see a response from the US federal government, the administration and Congress that. I think that's going to be part of the solution to supporting the economy... and ultimately stabilising the markets."

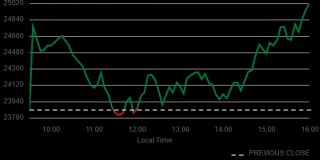

Earlier, shares in Japan rose after Prime Minister Shinzo Abe said his government would work closely with the central bank to boost the economy.

Japan's benchmark index, the Nikkei 225, had started Tuesday more than 3% down but bounced back following Mr Abe's comments to end 1% higher.

In Hong Kong, the main Hang Seng market rose 1.4% buoyed by Japan's moves to calm investors. The index had fallen more than 4% on Monday.

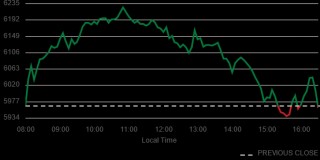

London's FTSE index was 0.23% higher at the end of Tuesday at 5,979.

The optimism on Tuesday was helped by a slowdown in reported cases of coronavirus in China, according to Michael Hewson, chief market analyst at CMC Markets UK.

"This optimism, along with expectations around further central bank actions is, for now, offsetting the news that the whole of Italy has gone into lockdown and the Spanish government has taken the decision to close all schools and universities in Madrid," he said.

Monday saw the steepest declines in many global financial markets since the 2008 financial crisis.

The major US stock indexes fell so sharply at the start of trading that the buying and selling of shares was halted for 15 minutes, as a so-called "circuit breaker" aimed at curbing panicky selling came into effect.

The dramatic falls in response to fears over the impact of the coronavirus were typical of market behaviour, said Kathleen Brooks, director at Minerva Analysis.

"Markets are so emotional, it's unbelievable," she said. "Act first, think later. This was the same in 2008, you have these massive declines and then the market is on pause."

She said she thought markets would recover eventually, as "if you look at long-term charts they always recover".

However, in the short term, "we could see another decline if we don't see the stimulus that's required. We need to hear more positive things because that's when stock markets go up."

Why should I care if stock markets fall?

Many people's initial reaction to "the markets" is that they are not directly affected, because they do not invest money.

Yet there are millions of people with a pension - either private or through work - who will see their savings (in what is known as a defined contribution pension) invested by pension schemes. The value of their savings pot is influenced by the performance of these investments.

So big rises or falls can affect your pension, but the advice is to remember that pension savings, like any investments, are usually a long-term bet.

Major central banks have pledged to pump cash into the financial system while governments are mulling stimulus measures to tackle the economic hit. These include cuts to interest rates to encourage companies to borrow money and expand.

However, former Bank of England governor Mervyn King told BBC 5 live's Wake Up to Money: "I don't think that a cut in interest rates now is actually going to do a great deal to help the situation, it maybe a sign of reassurance but it is not more than that.

"What is needed now are targeted measures to help business deal with a short-term crisis and collapse of their cash flow, and I think the Bank of England understands that very well."

- March 11, 2020

- Comment (0)

- Trackback(0)