Loading

Search

▼ Japan’s Cooperation in Alaska LNG Development Project Emerges in Japan-U.S. Tariff Negotiations; But Industry Concerns Exist

- Category:Other

Japan’s cooperation in the development of liquefied natural gas (LNG) in the U.S. state of Alaska has emerged as a bargaining chip in the ongoing Japan-U.S. tariff negotiations.

While U.S. President Donald Trump is expecting Japan, South Korea and other countries to participate in the development project, doing so is expected to require over ¥6 trillion, prompting some major trading companies and energy companies to question the profitability of the project.

Strong focus on U.S. side

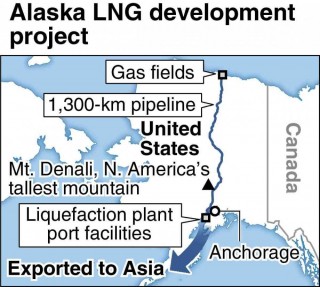

According to the Alaska Gasline Development Corp. (AGDC), which is responsible for the project, the plan is to lay a roughly 1,300-kilometer-long pipeline from gas fields in northern Alaska.

Gas from the fields will be transported to the Pacific coast in southern Alaska, from which the gas will be exported to the rest of the world, and 20 million tons of gas are expected to be exported to Asia per year.

At a Japan-U.S. summit in February, Japan agreed to work with the United States to expand imports of U.S. LNG. Trump in March said in an address to the U.S. Congress that Japan and South Korea wanted to partner with the United States on the project. In mid-May, Alaska Gov.

Mike Dunleavy stated that they were discussing a broad range of issues with Japan, South Korea and other countries. The U.S. side has shown strong enthusiasm for the project.

An international LNG conference is scheduled to take place in Alaska in early June, and officials from Japan, South Korea and Taiwan have been invited to it. Trump reportedly hopes that Japan and South Korea will express their willingness to participate in the development project at this conference.

The project is estimated to cost as much as $44 billion (about ¥6 trillion). If the project has participants from Asia, which are potential importers of the LNG, this will help reduce the burden on the U.S. side. In addition, Trump places strong emphasis on the project apparently because LNG exports will help reduce the U.S. trade deficit.

Harsh environment

The issue of the Alaska LNG project may seem to have emerged out of nowhere. However, for officials in the energy industry, the project has been discussed for over two decades.

Since the northern part of Alaska where the gas fields are located faces the ice-covered Arctic Ocean, it would be difficult to export gas directly from a port. If a pipeline is laid, it will enable the supply of LNG to southern urban areas through which the pipeline will run.

AGDC aims to start production in 2031. However, the construction of the pipeline will need to be done in a harsh environment as it is supposed to pass over 800 rivers and through three mountain ranges, including Mt. Denali, or Mt. McKinley, which is North America’s tallest mountain.

“I don’t think construction can be completed by 2031,” said a major trading company executive.

Some believe the construction costs could balloon to more than ¥10 trillion due to recent inflation.

Kenichi Hori, president of Mitsui & Co., Ltd., said, “It is necessary to thoroughly examine the economic potential and long-term sustainability of the entire project.”

Geopolitical risks

As LNG emits less carbon dioxide when burned than oil, Japan’s Strategic Energy Plan positions it as a realistic fuel for the time being. However, its supply is often influenced by geopolitical risks.

In Arctic LNG 2, an LNG project in Russia’s Arctic Circle in which Mitsui & Co. and other companies are participating, LNG production has been suspended due to economic sanctions against Russia and there is no prospect of LNG being supplied to Japan.

To diversify risk, major trading companies, power and gas companies, and others are working to diversify and expand their interests in Southeast Asia, Australia, the Middle East and North America.

If the Alaska project becomes operational, LNG could be delivered to Japan in about a week, which is expected to help reduce the number of days required for delivery.

Even so, there is deep-rooted concern regarding the project.

“If we end up buying more expensive energy, it will only result in the public having to bear a greater burden,” said a senior official of the energy industry.

The government and related companies will have to consider this issue carefully.

- May 28, 2025

- Comment (0)

- Trackback(0)