Loading

Search

▼ Inflation: Hip-Pocket Pain Hits Japan

- Category:Other

Soaring prices for consumer goods are hurting households around the globe, including in Japan. Items such as bread, corn, oil, gas, and noodles are costing more. People are worried that it's an ongoing trend -- and central banks are considering fiscal policy changes to address the hardship.

In Japan, some popular restaurant chains are altering their menus to cater to cash-strapped customers. Yoshinoya, Sukiya, and Matsuya have all raised the price of their gyu-don beef bowls, mainly due to higher beef prices. To ease the pain, they have also started serving cheaper chicken dishes.

At the grocery store, shoppers face sticker shock with food manufacturers planning to raise the prices of more than 3,000 products by July, according to a survey by credit research firm Teikoku Databank.

Japanese lawmakers have stepped in with a 2.7 trillion yen (about 21 billion dollars)supplementary budget that contains emergency measures designed to help ease the pressure.

The measures include offering subsidies to oil wholesalers to reduce retail gasoline prices and offering handouts to low-income households with children.

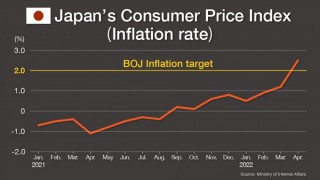

Consumer inflation in Japan during April exceeded two percent, beating the central bank's target for the first time in seven years. The figure is likely to remain above two percent -- at least until the end of the calendar year. Russia's invasion of Ukraine disrupted global supply chains and pushed up prices of food and energy. The European Union's additional ban on Russian oil imports is likely to exacerbate the issue. Wheat and corn exports from Ukraine and Russia have already been disrupted.

The wrong type of inflation

The consumer price rises resulting from geopolitical conflict are leading to cost-push inflation, not the demand-pull inflation that Japanese monetary policy has been aiming to achieve.

Mizuho Research and Technologies research finds individual households should expect to spend 50,000 yen (about 380 dollars) more in annual spending over the 2022 calendar year.

Gradual wage growth will not be enough to cover the extra cost of living.

BOJ policy holds firm

The Bank of Japan (BOJ) is maintaining aggressive monetary easing measures based on an assumption that consumer price increases are temporary -- and that the economy is not resilient enough to endure fiscal tightening.

"For the time being, the bank will stay on its course of monetary easing," the bank's Governor Kuroda Haruhiko told a May 26 news conference.

He had said previously he expects the national inflation rate to stabilize around 1.9 percent in the current fiscal year, "but it could slow to about one percent during the next one."

The BOJ approach is facing criticism for not being flexible enough to curb inflation -- or stop the yen's falling value.

While the cheaper yen is a blessing for many exporters, it is a burden for importers who pass on the extra costs for essentials including gasoline, electricity, and transportation, to households.

European Central Bank flags policy change

Until now, the European Central Bank (EBC) has been employing a monetary easing policy similar to that of the BOJ, including negative interest rates. But in the face of inflation hikes, it looks to be changing direction.

ECB President Christine Lagarde has signaled that the first interest rate increases in 11 years could come as early as July.

In a blog on the ECB website she writes, "Today, the conditions facing monetary policy have changed markedly. It is appropriate for policy to return to more normal settings rather than those aimed at raising inflation from very low levels."

She also says that the ECB is likely to exit its negative interest rate policy by the end of the third quarter in an effort to combat inflation.

Average inflation in the EU is more than eight percent, which far exceeds Japan's figure. But the European economy is likely to suffer more from the ongoing Ukraine conflict.

Lagarde writes in her blog that structural changes such as the so-called green transition on environmental issues, and continued geopolitical risks, will keep prices high in the long term. She believes that even when supply shocks fade, the disinflationary dynamics of the past decade are unlikely to return.

European approach "a good example"

The chief economist at Japan's Dai-ichi Life Research Institute, Tanaka Osamu, says the ECB policy change was to be expected. "The ECB's decision to tighten monetary policy is inevitable regarding economic and political perspectives in the region," Tanaka said.

The chief economist sees the fundamentals of the European and Japanese economies to be quite different, with much stronger wage hikes seen in Europe.

But he notes, "the ECB's exit from the negative interest rate policy may pose a good example for the BOJ in adjusting its monetary policy in the future, in terms of flexibility and gaining people's understanding of the central bank's position."

Tanaka added that "both the ECB and the BOJ will need delicate handling of monetary policy and good communication skills with the people amid downward risks that could drive down the global economy."

- June 7, 2022

- Comment (0)

- Trackback(0)