Loading

Search

▼ Global Economy / How To Achieve Growth Amid Falling Population

- Category:Event

With the population declining, is economic growth no longer possible? A pessimistic approach that gives up on growth is dangerous. We must face this grim reality and focus our efforts toward growth.

Sounding the alarm

“A rapidly aging population and a shrinking workforce mean the country will need to speed up reforms.” The International Monetary Fund emphasized this in its annual review issued on July 31, sounding the alarm about complacency and staying on the current course.

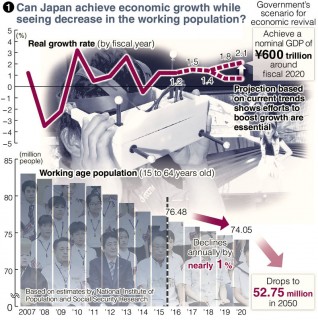

The working age population (see below) of 15- to 64-year-olds that supports society was over 87 million up until 1997, but about 76 million in 2016 — a decrease of more than 10 million people. It will continue to decline at a rate of nearly 1 percent each year (see chart 1). The overall population has declined by about 1 million from its peak, and a dwindling birthrate along with the aging society has led to a significant drop in the working age population.

Sounding the alarm

“A rapidly aging population and a shrinking workforce mean the country will need to speed up reforms.” The International Monetary Fund emphasized this in its annual review issued on July 31, sounding the alarm about complacency and staying on the current course.

The working age population (see below) of 15- to 64-year-olds that supports society was over 87 million up until 1997, but about 76 million in 2016 — a decrease of more than 10 million people. It will continue to decline at a rate of nearly 1 percent each year (see chart 1). The overall population has declined by about 1 million from its peak, and a dwindling birthrate along with the aging society has led to a significant drop in the working age population.

On the other hand, the nominal gross domestic product, an indicator of the scale of the Japanese economy, reached a historic high of ¥537 trillion in fiscal 2016, surpassing the previous peak of ¥533 trillion in fiscal 1997.

Prof. Hiroshi Yoshikawa of Rissho University asserts, “Pessimism about population decline has gone too far.”

Even if the labor force declines slightly, boosting productivity to increase the amount of goods and services produced by each worker will create positive growth. Innovation to boost growth potential is the key.

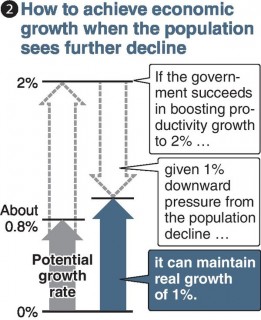

The potential growth rate, which indicates the potential of the Japanese economy, is currently about 0.8 percent per year. Boosting productivity growth to 2 percent, even with about 1 percent of downward pressure from the population decline, would enable real positive growth of 1 percent (see chart 2).

Prof. Hiroshi Yoshikawa of Rissho University asserts, “Pessimism about population decline has gone too far.”

Even if the labor force declines slightly, boosting productivity to increase the amount of goods and services produced by each worker will create positive growth. Innovation to boost growth potential is the key.

The potential growth rate, which indicates the potential of the Japanese economy, is currently about 0.8 percent per year. Boosting productivity growth to 2 percent, even with about 1 percent of downward pressure from the population decline, would enable real positive growth of 1 percent (see chart 2).

The government aims to create real growth of 2 percent or more to achieve a nominal GDP of ¥600 trillion, but this is overly optimistic amid the negative pressures of the population decline. The real growth rates for fiscal 2015 and 2016 were both 1.2 percent.

Addressing inequality

Why is growth necessary? Branko Milanovic, who served as lead economist at the World Bank for many years, states in his much-discussed book “Global Inequality” that economic growth is the most powerful tool for reducing global poverty and inequality.

He makes the brutal point that if wealthy people in rich nations think things will be fine without further economic growth, they should simply embrace the status quo without making any effort to emerge from an economic downturn.

Western nations emphasize the importance of growth because of the widening gap between the young and the wealthy. In his inaugural address in May, French President Emmanuel Macron vowed: “Everything that contributes to France’s robustness and prosperity will be set in motion ...

Culture and education, through which emancipation, creativity and innovation are built, will be central to my action.” With unemployment rates of over 20 percent for young people, France is taking on reform of its labor market to boost competitiveness.

Make intl M&As carefully

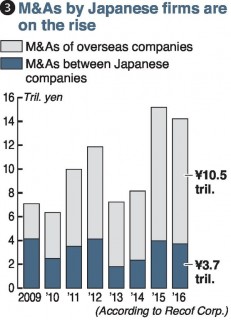

It makes sense for Japanese companies to make aggressive moves overseas. According to mergers and acquisitions advisory firm Recof Corp., overseas M&As by Japanese companies rose 13 percent in 2016 compared to the previous year, totaling about ¥10.5 trillion (see chart 3).

Addressing inequality

Why is growth necessary? Branko Milanovic, who served as lead economist at the World Bank for many years, states in his much-discussed book “Global Inequality” that economic growth is the most powerful tool for reducing global poverty and inequality.

He makes the brutal point that if wealthy people in rich nations think things will be fine without further economic growth, they should simply embrace the status quo without making any effort to emerge from an economic downturn.

Western nations emphasize the importance of growth because of the widening gap between the young and the wealthy. In his inaugural address in May, French President Emmanuel Macron vowed: “Everything that contributes to France’s robustness and prosperity will be set in motion ...

Culture and education, through which emancipation, creativity and innovation are built, will be central to my action.” With unemployment rates of over 20 percent for young people, France is taking on reform of its labor market to boost competitiveness.

Make intl M&As carefully

It makes sense for Japanese companies to make aggressive moves overseas. According to mergers and acquisitions advisory firm Recof Corp., overseas M&As by Japanese companies rose 13 percent in 2016 compared to the previous year, totaling about ¥10.5 trillion (see chart 3).

The United Nations predicts a 15 percent decline in the Japanese population by 2050 to just over 100 million, and a global population increase to about 9.8 billion from about 7.6 billion. Economic growth will likely boost incomes, leading to higher purchasing power in Asia and Africa.

But with rapid changes in the market, it is not easy to parlay these moves into growth. Toshiba Corp. found itself in trouble due to its U.S. nuclear power subsidiary, and Japan Post Holdings Co. took huge losses on its purchase of an Australian logistics company. There are many cases of Japanese companies paying a high purchase price, then leaving local subsidiaries to find their own way without sufficient control.

Shigenobu Nagamori, chairman and president of Nidec Corp., has a successful record in every one of his more than 50 M&As. He sets forth three requirements for purchases: don’t pay high prices; reform management of the purchased company; and create synergy.

Technological innovation within Japan will also be important. Kunio Noji, chairman of construction equipment giant Komatsu Ltd., which makes about 80 percent of its sales overseas, said: “Depending solely on existing businesses will allow developing nations to catch up. New businesses and industries must be created within Japan.”

New ways of thinking

As the population declines, we cannot expect growth akin to the era when the Japanese economy continued to expand. Regional cities must adopt new ways of thinking. For example, Pittsburgh was once known as the Steel City, with a population of nearly 700,000 at its peak. While its population is now less than half of that, health care and high-tech industries are thriving, and per capita income is higher than the U.S. average.

Germany has many small regional cities that have boosted their competitiveness through collaborations of industries, governments and academia, such as the UNESCO World Heritage Site of Regensburg.

The Japanese market remains attractive to foreign companies. The Japan External Trade Organization’s Invest Japan Report 2016 showed foreign direct investment in Japan was at a record high, and that nearly 80 percent of foreign companies planned to expand their investments.

Britain’s Dyson Ltd., known for vacuum cleaners with strong suction, and iRobot Corp., a U.S. manufacturer of the Roomba robotic vacuum cleaner, have enjoyed great success among Japan’s discerning consumers.

Bank of Japan statistics show ¥932 trillion was held by individuals in cash and deposits as of the end of March, an increase of nearly ¥150 trillion from 10 years ago. There is room yet to stoke demand in this aging society. With consumption by foreigners visiting Japan exceeding ¥2 trillion in just the first six months of this year, regional cities must adopt strategies to draw in tourists.

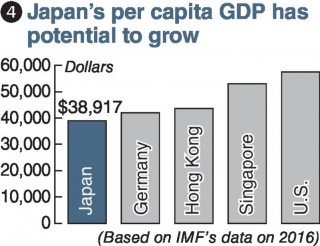

Japan’s 2016 per capita GDP was $38,917 (about ¥4.28 million) — nearly 30 percent lower than Singapore’s (see chart 4). Japan faces many challenges, such as low productivity in the service industry, low liquidity in the labor market, and insufficient talent in information technology.

As Japan ages at the fastest rate in the world, will it be able to transform its social structure into one that makes use of artificial intelligence and advanced technology? We must recognize that real growth of 1 percent will not be easy, and quickly move forward with initiatives.

■ Working age population

The population of people aged 15 to 64 that forms the core workforce. It includes people studying in high school and college as well as people who are not working. Since some people over 65 still work, it is not the total number of people with jobs. While the working age population continues to decline, the number of people aged 65 and above has reached about 35 million, nearly 30 percent of the overall population.

But with rapid changes in the market, it is not easy to parlay these moves into growth. Toshiba Corp. found itself in trouble due to its U.S. nuclear power subsidiary, and Japan Post Holdings Co. took huge losses on its purchase of an Australian logistics company. There are many cases of Japanese companies paying a high purchase price, then leaving local subsidiaries to find their own way without sufficient control.

Shigenobu Nagamori, chairman and president of Nidec Corp., has a successful record in every one of his more than 50 M&As. He sets forth three requirements for purchases: don’t pay high prices; reform management of the purchased company; and create synergy.

Technological innovation within Japan will also be important. Kunio Noji, chairman of construction equipment giant Komatsu Ltd., which makes about 80 percent of its sales overseas, said: “Depending solely on existing businesses will allow developing nations to catch up. New businesses and industries must be created within Japan.”

New ways of thinking

As the population declines, we cannot expect growth akin to the era when the Japanese economy continued to expand. Regional cities must adopt new ways of thinking. For example, Pittsburgh was once known as the Steel City, with a population of nearly 700,000 at its peak. While its population is now less than half of that, health care and high-tech industries are thriving, and per capita income is higher than the U.S. average.

Germany has many small regional cities that have boosted their competitiveness through collaborations of industries, governments and academia, such as the UNESCO World Heritage Site of Regensburg.

The Japanese market remains attractive to foreign companies. The Japan External Trade Organization’s Invest Japan Report 2016 showed foreign direct investment in Japan was at a record high, and that nearly 80 percent of foreign companies planned to expand their investments.

Britain’s Dyson Ltd., known for vacuum cleaners with strong suction, and iRobot Corp., a U.S. manufacturer of the Roomba robotic vacuum cleaner, have enjoyed great success among Japan’s discerning consumers.

Bank of Japan statistics show ¥932 trillion was held by individuals in cash and deposits as of the end of March, an increase of nearly ¥150 trillion from 10 years ago. There is room yet to stoke demand in this aging society. With consumption by foreigners visiting Japan exceeding ¥2 trillion in just the first six months of this year, regional cities must adopt strategies to draw in tourists.

Japan’s 2016 per capita GDP was $38,917 (about ¥4.28 million) — nearly 30 percent lower than Singapore’s (see chart 4). Japan faces many challenges, such as low productivity in the service industry, low liquidity in the labor market, and insufficient talent in information technology.

As Japan ages at the fastest rate in the world, will it be able to transform its social structure into one that makes use of artificial intelligence and advanced technology? We must recognize that real growth of 1 percent will not be easy, and quickly move forward with initiatives.

■ Working age population

The population of people aged 15 to 64 that forms the core workforce. It includes people studying in high school and college as well as people who are not working. Since some people over 65 still work, it is not the total number of people with jobs. While the working age population continues to decline, the number of people aged 65 and above has reached about 35 million, nearly 30 percent of the overall population.

- August 21, 2017

- Comment (0)

- Trackback(0)