Loading

Search

▼ Nikkei Inc. Announces It Will Buy Venerable Financial Times in ¥160 Billion Deal

- Category:Other

Thursday’s surprise announcement by Nikkei Inc. that it’s buying the London-based FT Group, one of the world’s most respected and influential media groups, immediately raised questions about whether the Japanese company can successfully manage such a highly regarded news company.

The Nikkei group, Japan’s most powerful financial media group, said it will buy the Financial Times publisher from Pearson PLC for about ¥160 billion ($1.3 billion) by procuring all outstanding stocks.

The price tag, however, looks rather high when compared with the ¥24.5 billion that Amazon.com CEO Jeff Bezos paid for The Washington Post in 2013.

Still, Takashi Kawachi, media analyst and former managing director of the Mainichi Shimbun, praised Nikkei’s decision because there seems to be little room for growth in the declining newspaper industry and Japan’s rapidly aging society.

“Over the past 10 years, the total circulation (of newspapers) has fallen rapidly in Japan and the most avid readers now are mostly in their 70s,” Kawachi said. “There is no doubt digitization and advancement into overseas markets are the only ways for Japanese newspaper companies to survive.”

The Nikkei group, Japan’s most powerful financial media group, said it will buy the Financial Times publisher from Pearson PLC for about ¥160 billion ($1.3 billion) by procuring all outstanding stocks.

The price tag, however, looks rather high when compared with the ¥24.5 billion that Amazon.com CEO Jeff Bezos paid for The Washington Post in 2013.

Still, Takashi Kawachi, media analyst and former managing director of the Mainichi Shimbun, praised Nikkei’s decision because there seems to be little room for growth in the declining newspaper industry and Japan’s rapidly aging society.

“Over the past 10 years, the total circulation (of newspapers) has fallen rapidly in Japan and the most avid readers now are mostly in their 70s,” Kawachi said. “There is no doubt digitization and advancement into overseas markets are the only ways for Japanese newspaper companies to survive.”

Thanks to highly developed delivery services, the pace of decline of Japanese newspapers is not as fast as in Western nations. Since 2000, the total daily circulation of Japanese newspapers had fallen 15.5 percent to 45.36 million as of last year.

Meanwhile FT.com, the digital version of the Financial Times, is seen as one of the world’s most successful Internet-based news services launched by a newspaper company.

On its website, Nikkei pointed out that FT.com now boasts about 500,000 paid subscribers for its digital edition, while Nikkei has 430,000. The two groups will promote various digital news projects by capitalizing on their customer bases, Nikkei said.

“(Nikkei and FT) will aim to evolve into an unprecedentedly powerful financial media group in the world by combining their human resources, including editors, and the tradition and knowledge,” Nikkei said on its website.

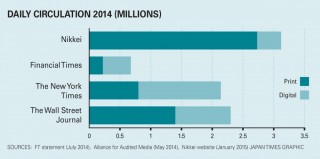

Nikkei, which has a total of 3.16 million paper and paid digital subscribers, has long been touted as Japan’s most powerful financial media group, best known for its Nikkei 225 stock average, the key gauge of the Tokyo Stock Exchange.

Meanwhile FT.com, the digital version of the Financial Times, is seen as one of the world’s most successful Internet-based news services launched by a newspaper company.

On its website, Nikkei pointed out that FT.com now boasts about 500,000 paid subscribers for its digital edition, while Nikkei has 430,000. The two groups will promote various digital news projects by capitalizing on their customer bases, Nikkei said.

“(Nikkei and FT) will aim to evolve into an unprecedentedly powerful financial media group in the world by combining their human resources, including editors, and the tradition and knowledge,” Nikkei said on its website.

Nikkei, which has a total of 3.16 million paper and paid digital subscribers, has long been touted as Japan’s most powerful financial media group, best known for its Nikkei 225 stock average, the key gauge of the Tokyo Stock Exchange.

Its flagship newspaper, whose formal name is Nihon Keizai Shimbun, is a must-read for Japanese investors and businessmen as it frequently carries scoops on domestic companies.

But at the same time the Nikkei has often been criticized for depending too much on leaks — apparently provided by corporate insiders — and the paper is often seen as reluctant to bluntly criticize Japanese firms.

For example, the Nikkei initially ignored the 2011 accounting scandal involving Olympus Corp., which in contrast was aggressively investigated and reported on by The Financial Times.

The Nikkei’s inaction regarding the Olympus scandal seriously damaged the firm’s international reputation.

But during a news conference Friday in Tokyo, Nikkei Chairman Tsuneo Kita tried to dismiss such concerns.

“I’d like to clearly say this: Independence of editorial policies, which is the most important thing for a news organization, will be maintained as has been in the past,” Kita said.

However, asked if that pledge will be written in a contract, CEO Naotoshi Okada indicated he would rather not. Instead, Nikkei would prefer having “frank talks” with Financial Times staff if they have major differences in opinions, he said.

Pressed to promise in public not to intervene in the Financial Times’ editorial policies or personnel affairs even if it tries to report on a major scandal involving a major Japanese company, or Nikkei itself, Okada said Nikkei’s pledge will apply to all such situations.

“Our remarks do cover all such things,” he said.

Ryosuke Nishida, a special associate professor of media studies at Ritsumeikan University, said Nikkei should not try to control the FT Group but instead learn from FT’s corporate governance and reporting style.

“Japanese newspaper companies are very inflexible, and their reporting methods have become outdated. Whether (Nikkei) can capitalize on the experience (of the FT), which has carried out many drastic reforms, is the critical question,” Nishida said.

Asked about a possible clash of the journalistic and corporate cultures of Nikkei and FT, Kawachi said Nikkei executives need to be mindful of public concern and should not intervene too much in either the FT’s management or editorial teams.

“(The buyout) has already drawn much public attention. I don’t think Nikkei will intervene too much in FT,” he said.

FT, which was established in 1888, has an editorial team of 500 journalists at more than 50 bureaus around the world.

Pearson PLC, a British-based education company, bought the FT Group in 1957.

Under the deal, Nikkei will acquire the Financial Times newspaper, FT.com, How to Spend It, FT Labs, FTChinese, the Confidentials and Financial Publishing.

“Pearson has been a proud proprietor of the FT for nearly 60 years. But we’ve reached an inflection point in media, driven by the explosive growth of mobile and social,” John Fallon, Pearson’s chief executive, was quoted as saying on Pearson’s website Thursday.

“In this new environment, the best way to ensure the FT’s journalistic and commercial success is for it to be part of a global, digital news company,” he said.

But at the same time the Nikkei has often been criticized for depending too much on leaks — apparently provided by corporate insiders — and the paper is often seen as reluctant to bluntly criticize Japanese firms.

For example, the Nikkei initially ignored the 2011 accounting scandal involving Olympus Corp., which in contrast was aggressively investigated and reported on by The Financial Times.

The Nikkei’s inaction regarding the Olympus scandal seriously damaged the firm’s international reputation.

But during a news conference Friday in Tokyo, Nikkei Chairman Tsuneo Kita tried to dismiss such concerns.

“I’d like to clearly say this: Independence of editorial policies, which is the most important thing for a news organization, will be maintained as has been in the past,” Kita said.

However, asked if that pledge will be written in a contract, CEO Naotoshi Okada indicated he would rather not. Instead, Nikkei would prefer having “frank talks” with Financial Times staff if they have major differences in opinions, he said.

Pressed to promise in public not to intervene in the Financial Times’ editorial policies or personnel affairs even if it tries to report on a major scandal involving a major Japanese company, or Nikkei itself, Okada said Nikkei’s pledge will apply to all such situations.

“Our remarks do cover all such things,” he said.

Ryosuke Nishida, a special associate professor of media studies at Ritsumeikan University, said Nikkei should not try to control the FT Group but instead learn from FT’s corporate governance and reporting style.

“Japanese newspaper companies are very inflexible, and their reporting methods have become outdated. Whether (Nikkei) can capitalize on the experience (of the FT), which has carried out many drastic reforms, is the critical question,” Nishida said.

Asked about a possible clash of the journalistic and corporate cultures of Nikkei and FT, Kawachi said Nikkei executives need to be mindful of public concern and should not intervene too much in either the FT’s management or editorial teams.

“(The buyout) has already drawn much public attention. I don’t think Nikkei will intervene too much in FT,” he said.

FT, which was established in 1888, has an editorial team of 500 journalists at more than 50 bureaus around the world.

Pearson PLC, a British-based education company, bought the FT Group in 1957.

Under the deal, Nikkei will acquire the Financial Times newspaper, FT.com, How to Spend It, FT Labs, FTChinese, the Confidentials and Financial Publishing.

“Pearson has been a proud proprietor of the FT for nearly 60 years. But we’ve reached an inflection point in media, driven by the explosive growth of mobile and social,” John Fallon, Pearson’s chief executive, was quoted as saying on Pearson’s website Thursday.

“In this new environment, the best way to ensure the FT’s journalistic and commercial success is for it to be part of a global, digital news company,” he said.

- September 29, 2018

- Comment (0)

- Trackback(0)