Loading

Search

▼ Framework To Be Developed To Boost ‘Fintech’ Services

- Category:Other

Megabanks and regional banks have started creating a framework to safely provide their customers’ information to burgeoning start-up companies that offer new services called fintech, a combination of financing and information technology.

The framework aims to prevent personal information from being leaked and give a further sense of security to customers.

Banks, fintech companies, the Financial Services Agency and experts established a review panel earlier this month and will compile a report by the end of this fiscal year.

Panel discussions are expected to focus on several issues from the viewpoint of user security, such as a system to obtain customers’ consent when banks give a fintech company their information, establishing a service for customers to make inquiries, sharing responsibility between banks and companies, and the handling of compensation when there is a problem.

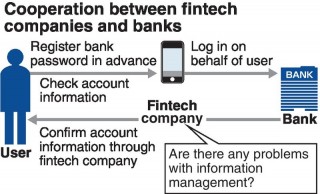

Banks preserve various types of personal information, including transaction balances and records of account activity. After receiving requests from users, fintech companies offer services based on users’ personal information from banks. The services include automatically doing household accounts and accounting.

But users are concerned about their personal information being leaked. Many fintech companies are allowed to obtain necessary information from banks by using a costumer’s identification data and password registered with banks. A framework that prevents such information from being leaked is essential.

Although the FSA can request financial institutions, including banks that are subject to its supervision, to carefully manage the information they have, it only loosely regulates and supervises fintech companies at the moment.

Banks have asked fintech companies through contracts for thorough information management and sharing responsibility when personal information is leaked. They aim at easily cooperating with fintech companies by drawing up unified security standards industrywide.

“Once a level of security and confidence of services is enhanced, the spread of the services will gain momentum,” said a source working at a fintech company.

- November 7, 2016

- Comment (0)

- Trackback(1)