Loading

Search

▼ Office Seekers, Tourists Up Land Prices

- Category:Other

By Kisaki Ozawa and Ryuichi Washio / Yomiuri Shimbun Staff Writers

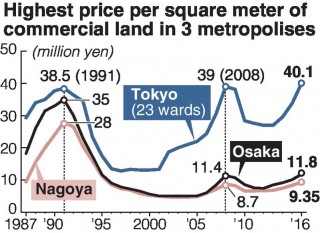

Helped by robust demand for commercial space in major cities, average official land prices (see below) nationwide rose for the first time in eight years in the government’s annual public assessment of land values. Against the backdrop of a moderate economic recovery, major redevelopments and infrastructure improvements such as to railways nationwide have helped boost demand for office space.

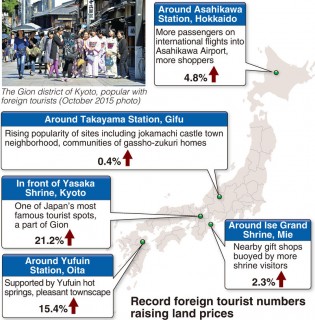

Additionally, record numbers of foreign tourists have led to a hotel and commercial facility construction boom.

Foreign visitors who shop

The largest increase in commercial land prices was seen in Osaka’s Shinsaibashi-suji shopping street. In June, Shinsaibashi outlet of footwear retailer ABC-Mart Inc. surpassed the company’s main store in Shinjuku, Tokyo, in terms of monthly sales to top the company rankings.

Thanks to tourists from China and elsewhere looking for sneakers, sales at the store have nearly doubled since 2013. “In just two years, we’ve passed the top 20 or 30 outlets,” a store manager said.

Businesses are scrambling to open stores around the shopping street, hoping to attract consumers — mainly foreign tourists who purchase massive amounts of goods in so-called binge shopping sprees.

In 2015 alone, 16 new stores opened, including luxury foreign brands such as Burberry, sporting goods retailers such as Adidas and fast-fashion outlets such as H&M. Rents at some properties have increased 20 percent or more.

The Ginza district of Tokyo, which set a record for commercial land prices, was crowded with tourist buses on a day in mid-March. Ginza Karen, a bag specialty store, was filled with foreign tourists looking for suitcases to carry their bulk purchases.

“Sales doubled in 2015 compared to the previous year,” said the store’s manager, Koichi Miwa, 50. “They’ll increase even more after redevelopment.”

Ginza is in the midst of a shop and hotel construction boom.

Mori Building Co. and others are planning to open a large commercial facility in 2017 that includes a parking lot for tourist buses. It will be located on the former site of the Matsuzakaya department store. Mori Trust Co. is investing in real estate at prime spots with plans to open a hotel as early as fiscal 2019.

Land values also increased outside major cities. Prices around Kanazawa Station in Ishikawa Prefecture rose 31.2 percent after an extension to the Hokuriku shinkansen bullet train opened in March 2015.

New commercial buildings

Demand for office space is also strong. Land values rose across central Tokyo, including in the Marunouchi and Otemachi districts. Land prices in the Toranomon district, where construction of a new subway station is under way, increased by 17 percent.

In Tokyo’s five central wards of Chiyoda, Chuo, Minato, Shinjuku and Shibuya, rent for large office buildings rose by about 20 percent between the end of 2011 and 2015, according to CBRE Inc., a major real estate services company.

Industries that have done well recently, such as finance and manufacturing, are adding workers, while some foreign-capital technology, pharmaceutical and other companies have moved to newer buildings.

The Linear Chuo Shinkansen bullet train line, expected to open in 2027, has spurred construction of high-rise buildings near Nagoya Station. Commercial property in buildings to the east ranked third in terms of growth nationwide, while those to its west ranked fifth.

While these may seem like localized bubbles, the Land, Infrastructure, Transport and Tourism Ministry views them differently to the dramatic increases in land prices seen during the bubble economy that were largely detached from concepts like profit and convenience.

The price increases “are backed by factors such as higher rents and demand for store construction,” the ministry’s land price office said. “These movements do not appear to come from speculative transactions.”

Nevertheless, the Bank of Japan’s large-scale monetary easing policy is injecting large amounts of investment capital into the market, which has heightened worries over speculative real estate deals.

It is also unclear how other economic factors will affect land prices in 2016. These include the deceleration of the Chinese economy, a lack of clarity in stock prices and exchange rates, and the central bank’s negative interest rate policy.

■Official land prices

These prices are used as yardsticks for private real estate deals and when the government acquires land for public works projects. Based on the Public Notice of Land Prices Law, land prices per square meter as of Jan. 1 every year are surveyed by real estate appraisers at standard designated locations nationwide by referencing transactions in the area. The results are published by the Land, Infrastructure, Transport and Tourism Ministry’s Land Appraisal Committee.

- March 25, 2016

- Comment (0)

- Trackback(0)