Loading

Search

▼ Major Mobile Carriers Moving Into Budget Market

- Category:Event

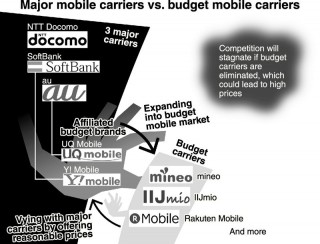

Major mobile phone carriers KDDI Corp., which operates the au brand service, and SoftBank Group Corp. are increasingly expanding into the budget market. This is because independent carriers are attracting more users by offering reasonable services under brands such as IIJmio and mineo.

The Internal Affairs and Communications Ministry has so far aimed to reduce communication charges by having major carriers and budget carriers compete with each other. However, competition will stagnate if major carriers increase their presence in the budget mobile market, and this could lead to high communication charges. The ministry is carefully keeping an eye on the moves of the major carriers. A KDDI subsidiary provides budget communication services under the UQ mobile brand.

“We will make use of two wheels — the au and UQ brands — to increase contracts,” KDDI President Takashi Tanaka said at a press conference held in early February to announce financial results. He made clear the company’s intention to strengthen its budget mobile business. The monthly fee for its UQ-brand smartphone starts from ¥1,980 — including phone charges but excluding tax — which is about 60 percent cheaper than au-brand smartphones.

KDDI plans to rapidly increase the number of sales outlets specializing in the UQ brand from the current 27 to 100 within fiscal 2017. Many independent budget mobile carriers have only a small number of their own sales outlets and accept subscriptions mainly via the internet. If KDDI expands its sales outlets network, it could attract customers who are unfamiliar with the internet or lack knowledge about setting up mobile phones.

SoftBank offers the Y! mobile budget service. In June 2016, it reduced the cheapest monthly fee from ¥2,980 to ¥1,980 — the same as independent carriers and a clear indication of its intention to counter them.

There is concern within SoftBank about losing customers. A senior executive of the company said that a profit decrease would be “better than losing customers to other carriers.”

Budget communication services accounted for 8.6 percent of the mobile phone market as of September 2016. With the share having reached nearly 10 percent, they are making their presence felt in the market.

According to a survey by MM Research Institute in December 2016, the average monthly usage fee of budget mobile phones with a standard voice call function was ¥2,484, and ¥1,862 for those without the standard function. The communication charges of major carriers have been lowered to levels similar to independent carriers.

The annual sales of the three major carriers, which boast nationwide sales outlet networks, range from ¥4 trillion to less than ¥10 trillion. Some independent mobile carriers are concerned that a full-fledged effort by the major carriers to enter the market could make it difficult for the independents to compete in terms of services and prices. Communication charges could remain high if independent carriers are wiped out by the major carriers.

Previously, budget carriers Emobile and Willcom competed with the three major carriers in the Japanese mobile phone market, but those two companies both became SoftBank affiliates. The ministry has been trying to develop independent mobile carriers in the belief that a “fourth power” is necessary to reduce communication charges.

The ministry plans to carefully monitor the competitive environment surrounding the budget mobile market to see if it remains fair, checking whether a major carrier gives preferential treatment, such as faster data communication speeds, to its group budget brands. “It is important to enable fair competition between the budget smartphone and major carriers,” Internal Affairs and Communications Minister Sanae Takaichi said at a press conference on March 3.Speech

- March 14, 2017

- Comment (0)

- Trackback(1)

Comment(s) Write comment

Trackback (You need to login.)

The youre really talented .

- cheap albion online gold for sale

- March 27, 2017