Loading

Search

▼ Kumamon, Japan’s Billion-Dollar Bear, Ventures Abroad

- Category:Other

Watch out Mickey Mouse, Kumamoto's popular mascot is going global KUMAMOTO, Japan / BANGKOK -- A small prefecture in western Japan is taking its bear mascot global, in a challenge to entertainment juggernauts like Walt Disney who dominate the world’s $123 billion character licensing market.

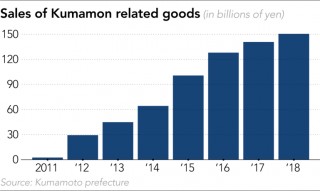

With its pitch black fur, red cheeks and white eyes, Kumamon has become a phenomenon in Japan. Sales of goods carrying its cheery image topped 150 billion yen ($1.4 billion) last year. Now the Kumamoto government is accelerating international expansion of the brand in a partnership announced on Thursday with major Thailand conglomerate Saha Group to roll out Kumamon-branded products in the country.

Saha, which is known for household consumer brands like Mama instant noodles, aims to use Kumamon in fashion and lifestyle products to target middle class consumers. The license will be held by Saha unit ICC International, which distributes clothes and cosmetics to department stores.

Since opening up the use of Kumamon to foreign companies last October, Kumamoto has struck licensing deals with Animation International and IMMG Beijing for products sold in China, Hong Kong and Taiwan. Hot on the heels of its Saha partnership, it is nearing a deal in South Korea, according to a Kumamoto official.

Kumamon's success has been based on clever marketing. The bear is not just a mascot. He has been made sales manager for Kumamoto, a prefecture on the southern Japanese island of Kyushu that has been struggling to recover from an earthquake in 2016.

One Kumamoto official said Kumamon goes on about 100 ‘overseas business trips’ a year and he has his own office just five minutes' walk from the city hall.

With its pitch black fur, red cheeks and white eyes, Kumamon has become a phenomenon in Japan. Sales of goods carrying its cheery image topped 150 billion yen ($1.4 billion) last year. Now the Kumamoto government is accelerating international expansion of the brand in a partnership announced on Thursday with major Thailand conglomerate Saha Group to roll out Kumamon-branded products in the country.

Saha, which is known for household consumer brands like Mama instant noodles, aims to use Kumamon in fashion and lifestyle products to target middle class consumers. The license will be held by Saha unit ICC International, which distributes clothes and cosmetics to department stores.

Since opening up the use of Kumamon to foreign companies last October, Kumamoto has struck licensing deals with Animation International and IMMG Beijing for products sold in China, Hong Kong and Taiwan. Hot on the heels of its Saha partnership, it is nearing a deal in South Korea, according to a Kumamoto official.

Kumamon's success has been based on clever marketing. The bear is not just a mascot. He has been made sales manager for Kumamoto, a prefecture on the southern Japanese island of Kyushu that has been struggling to recover from an earthquake in 2016.

One Kumamoto official said Kumamon goes on about 100 ‘overseas business trips’ a year and he has his own office just five minutes' walk from the city hall.

Kumamon already has a strong fan base in China. On Sundays, hundreds of tourists flock to a store in Kumamoto to catch a glimpse of the mascot. The crowd erupts with applause when the bear dazzles the crowd with dances, jumps and hugs.

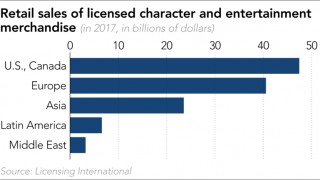

Kumamon's popularity in China is an advantage as it looks to take a slice of the $122.7 billion global industry for licensed entertainment and character products. Asia only accounts for around a fifth of the overall market, but is the fastest growing region along with Latin America, according to Licensing International, the trade organization for the global industry .

Ikuo Kabashima, the Harvard educated governor of Kumamoto, has said elevating Kumamon to the global stage is crucial for the character "to be loved for 100, 200 years... like Mickey Mouse." It is also key to turning Kumamon into a serious business.

Kumamoto lets domestic companies use the character for free, but charges a license fee of a few percent on product sales by foreign companies. The purpose, the local administration said, is to cover the costs of managing the character without relying on taxpayer money. But after its license partner’s share and other costs, like legal fees for trademark applications, are deducted, Kumamoto will receive a portion of the remaining profit.

Kumamon's popularity in China is an advantage as it looks to take a slice of the $122.7 billion global industry for licensed entertainment and character products. Asia only accounts for around a fifth of the overall market, but is the fastest growing region along with Latin America, according to Licensing International, the trade organization for the global industry .

Ikuo Kabashima, the Harvard educated governor of Kumamoto, has said elevating Kumamon to the global stage is crucial for the character "to be loved for 100, 200 years... like Mickey Mouse." It is also key to turning Kumamon into a serious business.

Kumamoto lets domestic companies use the character for free, but charges a license fee of a few percent on product sales by foreign companies. The purpose, the local administration said, is to cover the costs of managing the character without relying on taxpayer money. But after its license partner’s share and other costs, like legal fees for trademark applications, are deducted, Kumamoto will receive a portion of the remaining profit.

ADK Holdings, the advertising agency that handles Kumamon's overseas partnerships, aims to turn a profit by around 2021. If Kumamon sales overseas prove as popular as at home, Kumamoto stands to make tens of millions of dollars profit a year.

But, in Japan, the license-free policy means Kumamon does not directly produce income for local government coffers. So income from overseas sales will be key to helping the prefecture rebuild the local economy after the 2016 earthquake, which badly damaged Kumamoto Castle, one of its most popular tourist destinations.

Kumamon was conceived in 2010 as part of a promotion campaign for the Kyushu high-speed railway line. At the time a wave of local municipalities and companies sought to use ‘yuru-kyara’, or ‘relaxing characters’, to promote local products and attractions. At the peak of the yuru-kyara boom, a national mascot contest attracted more than 1,700 entries.

But Kumamon's official launch -- scheduled for March 12, 2011 -- was marred by the devastating earthquake and tsunami that struck eastern Japan on the eve of his first appearance. Despite delaying his debut, Kumamon won the mascot contest that year and eventually took on a life of his own.

His survival is remarkable given that a 2014 government survey found that many municipalities were investing heavily in mascots and merchandise without seeing any meaningful benefits. But the decision by governor Kabashima to grant free product licences for the character now appears to be a master stroke.

More importantly, the bear has been given a back story and personality that has drawn fans across the country. Kumamon was hired as a part-time civil servant at Kumamoto before being elevated to sales manager. The measures generated headlines and helped push Kumamon's popularity beyond Kumamoto.

But Kumamon still has a limited budget and will face an uphill challenge overseas, where he will compete against characters with deep pocketed sponsors. Disney spent $5.5 billion for its theme park in Shanghai, while Sanrio, the company behind Hello Kitty, is developing an indoor theme park in Vietnam’s Hanoi. In comparison, Kumamon runs on an annual budget of around $3.8 million.

But, in Japan, the license-free policy means Kumamon does not directly produce income for local government coffers. So income from overseas sales will be key to helping the prefecture rebuild the local economy after the 2016 earthquake, which badly damaged Kumamoto Castle, one of its most popular tourist destinations.

Kumamon was conceived in 2010 as part of a promotion campaign for the Kyushu high-speed railway line. At the time a wave of local municipalities and companies sought to use ‘yuru-kyara’, or ‘relaxing characters’, to promote local products and attractions. At the peak of the yuru-kyara boom, a national mascot contest attracted more than 1,700 entries.

But Kumamon's official launch -- scheduled for March 12, 2011 -- was marred by the devastating earthquake and tsunami that struck eastern Japan on the eve of his first appearance. Despite delaying his debut, Kumamon won the mascot contest that year and eventually took on a life of his own.

His survival is remarkable given that a 2014 government survey found that many municipalities were investing heavily in mascots and merchandise without seeing any meaningful benefits. But the decision by governor Kabashima to grant free product licences for the character now appears to be a master stroke.

More importantly, the bear has been given a back story and personality that has drawn fans across the country. Kumamon was hired as a part-time civil servant at Kumamoto before being elevated to sales manager. The measures generated headlines and helped push Kumamon's popularity beyond Kumamoto.

But Kumamon still has a limited budget and will face an uphill challenge overseas, where he will compete against characters with deep pocketed sponsors. Disney spent $5.5 billion for its theme park in Shanghai, while Sanrio, the company behind Hello Kitty, is developing an indoor theme park in Vietnam’s Hanoi. In comparison, Kumamon runs on an annual budget of around $3.8 million.

"Kumamon has elements of Japan’s kawaii. It has a good chance of becoming popular," said Sadashige Aoki, a professor at Hosei University in Tokyo, referring to Japan’s culture of cuteness. "But it does not have entertainment or content outside Japan, which is key to gaining popularity globally."

Kumamoto officials said early signs are promising, however. The mascot generated 1.9 billion yen in sales of licensed products overseas over the last three months of 2018, about half of what it achieved in all of 2017. It is working with U.S. studio Tonko House to create animation in the hopes of gaining fans in the U.S. and Europe.

Many governments are following his progress closely, say Kumamoto officials. "A lot of governments are now interested in yuru-kyara," said one.

But Kumamon will still have to compete with other popular Japanese characters who have already made their names internationally, said Rebecca Tse So-han, general manager of marketing at Yata department store in Hong Kong.

The Yata chain was the first company to introduce Kumamon to Hong Kong. It not only sells the goods, but develops its own Kumamon merchandise.

Tse said the bear has been very popular since Yata first launched merchandise ranging from T-shirts to cushions in 2013. But so too are other Japanese brands like Hello Kitty and the cartoon characters used by messaging app LINE.

"We would not restrict ourselves to certain products,” she said. "You know how fickle Hong Kongers can be."

Kumamoto officials said early signs are promising, however. The mascot generated 1.9 billion yen in sales of licensed products overseas over the last three months of 2018, about half of what it achieved in all of 2017. It is working with U.S. studio Tonko House to create animation in the hopes of gaining fans in the U.S. and Europe.

Many governments are following his progress closely, say Kumamoto officials. "A lot of governments are now interested in yuru-kyara," said one.

But Kumamon will still have to compete with other popular Japanese characters who have already made their names internationally, said Rebecca Tse So-han, general manager of marketing at Yata department store in Hong Kong.

The Yata chain was the first company to introduce Kumamon to Hong Kong. It not only sells the goods, but develops its own Kumamon merchandise.

Tse said the bear has been very popular since Yata first launched merchandise ranging from T-shirts to cushions in 2013. But so too are other Japanese brands like Hello Kitty and the cartoon characters used by messaging app LINE.

"We would not restrict ourselves to certain products,” she said. "You know how fickle Hong Kongers can be."

- June 28, 2019

- Comment (0)

- Trackback(0)