Loading

Search

▼ Tax System Revisions Aim to Boost Business Restructuring

- Category:Other

The government and ruling parties plan to revise the tax system in a bid to provide a boost to the business restructuring of Japanese companies, The Yomiuri Shimbun has learned.

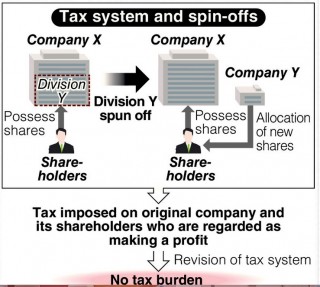

Under the current tax system, when a company separates its business divisions or subsidiaries and makes them fully independent, corporate income tax and other charges are imposed on the company as it is considered to have earned a profit by selling assets. The revisions being considered will remove this tax burden, aiming to encourage companies to flexibly reorganize their businesses and lead to the vitalization of the Japanese economy.

The revisions will be included in the ruling bloc’s outline for tax system revisions for fiscal 2017, which is slated to be compiled in December.

The spin-off is a method that a company uses to separate a specific business division as an independent firm that has no capital ties to the company and allocate the new firm’s shares to existing shareholders. This is a typical method for restructuring businesses in Europe and the United

States, and it is not uncommon for a newly spun off firm to grow rapidly.

In a spin-off, a company cedes such items as land and equipment to the newly created firm without charge. However, the spin-off has incurred corporate income tax in Japan because the original company is considered to have made a profit from selling equipment and other assets to the new firm. Income tax is also charged to shareholders of the original firm, as they are provided with shares from the spin-off.

In Japan, when Chugai Pharmaceutical Co. spun off its subsidiary, the corporate income tax charged to the company and income tax imposed on Chugai’s shareholders who received the new firm’s shares totaled about ¥35 billion.

The spin-off process is not subject to taxation in countries such as the United States. However, companies in Japan have hardly made good use of spin-offs due to the heavy tax burden, among other reasons.

In light of this situation, the Economy, Trade and Industry Ministry requested a revision of the tax system in an attempt to abolish the tax imposition on spin-offs, as the ministry considers business restructuring via the method as necessary to develop new growth industries in the country.

Income tax on shareholders is also planned to be revised so they will be taxed not when they are allocated shares of a newly spun off firm, but when they actually sell the new firm’s shares.

- December 3, 2016

- Comment (0)

- Trackback(0)