Loading

Search

▼ Japan Government Presses Companies to Raise Wages

- Category:Other

WSJ

During the new year’s greeting season earlier this month, Japanese Prime Minister Shinzo Abe and Bank of Japan Gov. Haruhiko Kuroda spent some extra hours with corporate executives, clinking glasses and golfing. Their mission: persuading corporate Japan to hand out generous raises to workers during annual wage negotiations.

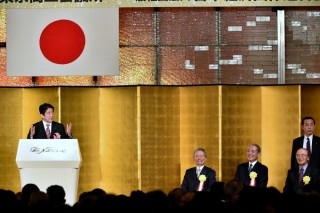

“I want you, the executives who have gathered here today, to make a brave decision,” Mr. Abe said at a New Year party hosted by Japan’s three largest business lobbies on Jan. 6. “When can you take action if not now?”

As Japan’s economic recovery falters and doubts grow about Mr. Abe’s aggressive stimulus policy known as Abenomics, Tokyo is stepping up pressure on companies to play their part. Many corporations are enjoying record profits, thanks to early benefits of Abenomics such as a stock market rally and the yen’s decline. Tokyo wants to see more of those profits passed on to workers to rejuvenate sluggish consumer spending and end deflation.

Officials are focused on the spring wage talks between management and labor, a weeks-long process that launched earlier this week. The negotiations, known as shunto, are a tradition since the 1950s, where wage agreements reached at big manufacturers set the tone for other industries.

There are signs that the cajoling by Messrs. Abe and Kuroda may be working. On Monday, Nomura Securities announced a plan to raise the average base salary for younger employees by 2.3%. Other big companies like electronics maker Fujitsu Ltd. , retail giant Seven and i Holdings Co. and shipping company Mitsui O.S.K . Lines have also signaled their willingness for pay rises.

“I expect companies to make aggressive action,” said Sadayuki Sakakibara, chairman of the Japan Business Federation, a powerful business lobby known as Keidanren. Mr. Sakakibara, who is also chairman of textile maker Toray Industries Inc., said Keidanren would like to see its members raise wages at least 2.2%—the same level as last year when the increase exceeded the 2% mark for the first time since 2001.

“It’s the responsibility of the management to reward the community and employees,” said Akio Toyoda , chief executive of Toyota Motor Corp. Aided by the yen’s weakness resulting from the BOJ’s monetary easing, Toyota is on its way to posting a record profit for the second straight year for the year ending March 31.

Labor is emboldened. The Japan Trade Union Confederation, a big umbrella group for unions, is seeking a raise of at least 4%, the biggest increase sought since 1998.

Keidanren signaled such generous raises were unlikely in its guidelines released Tuesday for its 1,309 member companies. Still, the group encouraged members to consider a base wage increase as an “option.”

The outcome of the wage talks could have a critical impact on the success of Abenomics. The policy aims to create a virtuous cycle where higher corporate profits cascade into more worker pay and consumption, which accounts for 60% of the nation’s economic output. Consumer demand has stagnated since a national sales-tax increase last April, pushing the economy into a recession.

Whether the BOJ can meet its goal to generate 2% inflation by early next year also depends largely on wages, which historically move in tandem with prices, people close to the central bank said. Weak consumer demand has helped to push down inflation sharply, forcing the BOJ to nearly halve its price forecast for the next fiscal year from April to 1.0% Wednesday.

Some economists play down the impact of the shunto negotiations on the broader wage and price trend. Those talks affect union workers only at relatively large companies and account for just 17.5% of the nation’s total workforce, according to Miki Ohata, an economist at Mitsubishi UFJ Research & Consulting. The rest are part-timers and contract workers, as well as nonunion employees. Non-regular workers, many with few benefits and little job security, now account for a record 38% of the Japanese labor force, up from 31% a decade ago.

Mr. Abe’s intervention in the wage talks is unusual for a free-market economy, but few have publicly voiced criticism. Economists agree that in order to liberate the economy from the grip of deflation, bold steps are needed to reverse the downturn in wages. Corporate executives seem to share those views.

Mr. Abe’s determination to influence the wage talks was evident throughout the new year’s greeting season. He hit the green with Keidanren’s Mr. Sakakibara on Jan. 3. Mr. Abe’s choice of golfing partners for his first game of the year is watched closely as an informal gauge of his policy priority.

Meanwhile, Mr. Kuroda visited individual corporate executives privately to plead for wage increases, according to people close to the central bank. He also became the first BOJ chief to participate in the new year’s reception of the Japan Trade Union Confederation. Some interpreted the visit as his endorsement of the labor group’s push for big raises.

For Japan’s price prospects, “nothing is more important than wage movement,” Mr. Kuroda said at a news conference in December.

- January 23, 2015

- Comment (0)

- Trackback(0)