Loading

Search

▼ Popularity of Minicars, Pedelecs Hurts Domestic Motorcycle Sales

- Category:Driving

The domestic motorcycle market has been stuck in the slow lane. Reasonably priced minicars and electrically assisted pedal cycles (pedelecs) have become increasingly popular, hurting sales of mopeds, which were once a familiar mode of transport for many people.

Major manufacturers plan to devote more resources to developing midsize and large motorbikes that offer bigger margins, but there are also concerns this could accelerate the shift of younger people away from such vehicles.

Manufacturers are caught between a rock and a hard place.

“The moped market is particularly tough,” Yamaha Motor Co. President Hiroyuki Yanagi said at a joint press conference in Tokyo on Saturday. Executives from four major motorbike manufacturers — Yamaha, Honda Motor Co., Kawasaki Heavy Industries Ltd. and Suzuki Motor Corp. — called for the press conference on this year’s “motorcycle day,” a pun using the Japanese readings for the numbers representing Aug. 19.

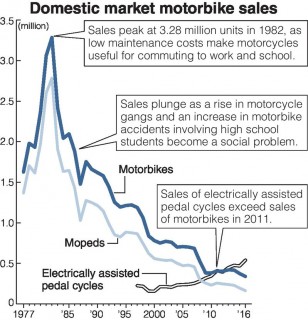

According to the Japan Automobile Manufacturers Association (JAMA), 338,000 motorcycles were sold in Japan in 2016, barely one-tenth the 3.285 million units sold at the industry’s peak in 1982.

In recent years, sales of mopeds with an engine displacement of 50cc or smaller, which previously accounted for about half of all motorbike sales, have been notably sluggish.

Major manufacturers plan to devote more resources to developing midsize and large motorbikes that offer bigger margins, but there are also concerns this could accelerate the shift of younger people away from such vehicles.

Manufacturers are caught between a rock and a hard place.

“The moped market is particularly tough,” Yamaha Motor Co. President Hiroyuki Yanagi said at a joint press conference in Tokyo on Saturday. Executives from four major motorbike manufacturers — Yamaha, Honda Motor Co., Kawasaki Heavy Industries Ltd. and Suzuki Motor Corp. — called for the press conference on this year’s “motorcycle day,” a pun using the Japanese readings for the numbers representing Aug. 19.

According to the Japan Automobile Manufacturers Association (JAMA), 338,000 motorcycles were sold in Japan in 2016, barely one-tenth the 3.285 million units sold at the industry’s peak in 1982.

In recent years, sales of mopeds with an engine displacement of 50cc or smaller, which previously accounted for about half of all motorbike sales, have been notably sluggish.

“The spread of minicars and pedelecs has given consumers more options, which has cut into sales of mopeds,” a source at a major motorcycle maker said.

Pedelecs are mostly priced from about ¥100,000 to ¥150,000. These two-wheelers are relatively cheap compared with mopeds, which tend to range from ¥150,000 to more than ¥200,000, and users do not need a driver’s license or have to buy gasoline.

Sales of pedelecs eclipsed purchases of motorcycles in 2011, and in 2016 their sales had climbed to 540,000 units — 1.6 times the number of motorcycles sold that year.

Given these market conditions, major manufacturers are shifting greater resources to midsize and larger motorcycles with an engine displacement of 126cc or more that offer a greater profit margin. Epitomizing this change was the decision by Honda and Yamaha in March to cooperate on the development and production of mopeds in a bid to divert more managerial resources to larger motorcycles.

This was a stunning move from two companies that were engaged in a fierce sales war in the early 1980s — especially for mopeds — that was dubbed the “HY war.”

Suzuki’s management plan also incorporates a greater concentration on the development of midsize and large products. Kawasaki Heavy wants to popularize its brand, which has been specializing in midsize and large motorcycles.

However, some observers fear that shifting to a focus on midsize and larger motorcycles that tend to be priced from about ¥500,000 to ¥600,000 could make young people, who have little money to spare for such large purchases, turn away from motorbikes.

According to a fiscal 2015 survey conducted by the JAMA, the average age of a motorcycle purchaser was 52.9 years, 1.5 years older than in fiscal 2013.

“If this trend continues, our business will quickly fizzle out,” said Katsuaki Watanabe, a director at Yamaha.

Major manufacturers have had some success with their greater emphasis on sports models featuring stylish designs to attract younger riders, with domestic sales of motorcycles of 126cc to 250cc in January-June this year increasing about 20 percent from the same period last year.

“If we can provide younger generations with the fun and excitement they’re expecting, they’ll come back to us,” said Noriake Abe, a Honda operating officer and chief officer of the company’s motorcycle operations.

Pedelecs are mostly priced from about ¥100,000 to ¥150,000. These two-wheelers are relatively cheap compared with mopeds, which tend to range from ¥150,000 to more than ¥200,000, and users do not need a driver’s license or have to buy gasoline.

Sales of pedelecs eclipsed purchases of motorcycles in 2011, and in 2016 their sales had climbed to 540,000 units — 1.6 times the number of motorcycles sold that year.

Given these market conditions, major manufacturers are shifting greater resources to midsize and larger motorcycles with an engine displacement of 126cc or more that offer a greater profit margin. Epitomizing this change was the decision by Honda and Yamaha in March to cooperate on the development and production of mopeds in a bid to divert more managerial resources to larger motorcycles.

This was a stunning move from two companies that were engaged in a fierce sales war in the early 1980s — especially for mopeds — that was dubbed the “HY war.”

Suzuki’s management plan also incorporates a greater concentration on the development of midsize and large products. Kawasaki Heavy wants to popularize its brand, which has been specializing in midsize and large motorcycles.

However, some observers fear that shifting to a focus on midsize and larger motorcycles that tend to be priced from about ¥500,000 to ¥600,000 could make young people, who have little money to spare for such large purchases, turn away from motorbikes.

According to a fiscal 2015 survey conducted by the JAMA, the average age of a motorcycle purchaser was 52.9 years, 1.5 years older than in fiscal 2013.

“If this trend continues, our business will quickly fizzle out,” said Katsuaki Watanabe, a director at Yamaha.

Major manufacturers have had some success with their greater emphasis on sports models featuring stylish designs to attract younger riders, with domestic sales of motorcycles of 126cc to 250cc in January-June this year increasing about 20 percent from the same period last year.

“If we can provide younger generations with the fun and excitement they’re expecting, they’ll come back to us,” said Noriake Abe, a Honda operating officer and chief officer of the company’s motorcycle operations.

- August 20, 2017

- Comment (0)

- Trackback(0)