Loading

Search

▼ Fidelity’s Japan Fund Bets on Nation’s 5G Stocks for 2020

- Category:Other

Fidelity International’s biggest equity fund in Japan is betting technology companies will help boost the nation’s stock market in 2020.

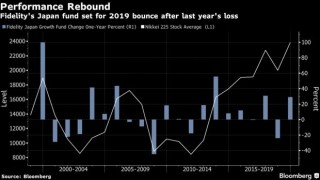

The asset manager’s Japan Growth Fund is up 29% this year, beating almost all of its peers, according to Bloomberg data. The fund has managed to stay ahead of the annual gains of Japan’s equity benchmarks most of the year.

Fidelity International’s $3.7 billion fund attributes 2019’s success to investments in growth stocks such as electronics and machinery makers. It expects 2020 to be another solid year, with the Nikkei 225 Stock Average rising an additional 5% from current levels.

“We think the Nikkei will try to reach 25,000 at some point next year,” Takashi Maruyama, head of equities Japan at Fidelity International, said in an interview in Tokyo. “There’s opportunity in 5G-related stocks, especially in areas that the markets haven’t priced in.”

Maruyama believes that demand for smartphones using the technology will spur business for parts manufacturers. The key will be finding 5G-related stocks that market participants have yet to factor in the technology’s potential, he said.

“I think you can see it quite bullishly,” he said. “It may still be unclear how much of 5G will be used in Japan, but there lies an opportunity,”

Fidelity’s faith in Japan’s technology stocks was tested this year as trade tensions between the U.S. and China damped earnings of semiconductor-related companies and electronic part manufacturers. Those sectors eventually recovered to become some of this year’s top-performers, with Advantest Corp. the Nikkei 225‘s biggest gainer for 2019.

“When the shares fell, we saw it as an opportunity to buy,” Maruyama said, adding that analysts visit companies as often as once every quarter.

Among its top picks is Miura Co., an industrial boiler manufacturer that has seen its shares surge more than 50% this year. The fund expects the company’s development of environmentally friendly boilers to attract demand from China and developing Asian countries.

The asset manager’s Japan Growth Fund is up 29% this year, beating almost all of its peers, according to Bloomberg data. The fund has managed to stay ahead of the annual gains of Japan’s equity benchmarks most of the year.

Fidelity International’s $3.7 billion fund attributes 2019’s success to investments in growth stocks such as electronics and machinery makers. It expects 2020 to be another solid year, with the Nikkei 225 Stock Average rising an additional 5% from current levels.

“We think the Nikkei will try to reach 25,000 at some point next year,” Takashi Maruyama, head of equities Japan at Fidelity International, said in an interview in Tokyo. “There’s opportunity in 5G-related stocks, especially in areas that the markets haven’t priced in.”

Maruyama believes that demand for smartphones using the technology will spur business for parts manufacturers. The key will be finding 5G-related stocks that market participants have yet to factor in the technology’s potential, he said.

“I think you can see it quite bullishly,” he said. “It may still be unclear how much of 5G will be used in Japan, but there lies an opportunity,”

Fidelity’s faith in Japan’s technology stocks was tested this year as trade tensions between the U.S. and China damped earnings of semiconductor-related companies and electronic part manufacturers. Those sectors eventually recovered to become some of this year’s top-performers, with Advantest Corp. the Nikkei 225‘s biggest gainer for 2019.

“When the shares fell, we saw it as an opportunity to buy,” Maruyama said, adding that analysts visit companies as often as once every quarter.

Among its top picks is Miura Co., an industrial boiler manufacturer that has seen its shares surge more than 50% this year. The fund expects the company’s development of environmentally friendly boilers to attract demand from China and developing Asian countries.

While the Japan Growth Fund has beat 95% of its peers in 2019, its ranking slips when assessed over a longer period, according to data compiled by Bloomberg. It drops to the 71 percentile for a three-year period and slips to the 68 percentile for a five-year span.

“To be honest, I’d like to see a more steady performance,” said Shoko Shinoda, a fund analyst at Rakuten Securities in Tokyo. “The last few years have been too bumpy.”

Shinoda still lauds the Japan Growth Fund for its history. Founded in 1998, it’s known for being a “longevity” fund, focusing on stocks with long-term potential, she said.

To ensure that the fund extends its winning streak, Fidelity’s Maruyama doesn’t rule out non-technology stocks such as a Shimano Inc., which makes products for bicycling, rowing, and fishing. The fund sees potential growth for the company’s electric bicycles.

“To be honest, I’d like to see a more steady performance,” said Shoko Shinoda, a fund analyst at Rakuten Securities in Tokyo. “The last few years have been too bumpy.”

Shinoda still lauds the Japan Growth Fund for its history. Founded in 1998, it’s known for being a “longevity” fund, focusing on stocks with long-term potential, she said.

To ensure that the fund extends its winning streak, Fidelity’s Maruyama doesn’t rule out non-technology stocks such as a Shimano Inc., which makes products for bicycling, rowing, and fishing. The fund sees potential growth for the company’s electric bicycles.

- December 23, 2019

- Comment (0)

- Trackback(0)