Loading

Search

▼ FSA Suspends 2 Crypto Marts

- Category:Event

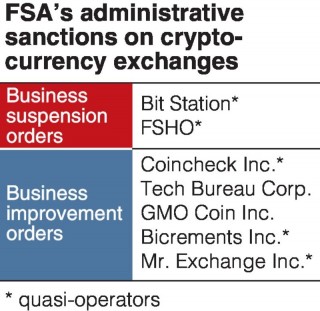

The Financial Services Agency announced Thursday that it has issued business suspension orders for the first time to two virtual currency exchanges that were so-called quasi-operators, allowed to conduct business even though their applications for registration were still being screened.

Nagoya-based Bit Station and Yokohama-based FSHO were punished mainly for failing to adequately protect customers. Based on the revised Payment Services Law, the two exchange operators were ordered to suspend all their operations, except for cryptocurrency withdrawals, from Thursday to April 7.

The FSA also has issued a second business improvement order to Tokyo-based Coincheck Inc., which was robbed of huge amounts of virtual currency. The first order was issued on Jan. 29.

Nagoya-based Bit Station and Yokohama-based FSHO were punished mainly for failing to adequately protect customers. Based on the revised Payment Services Law, the two exchange operators were ordered to suspend all their operations, except for cryptocurrency withdrawals, from Thursday to April 7.

The FSA also has issued a second business improvement order to Tokyo-based Coincheck Inc., which was robbed of huge amounts of virtual currency. The first order was issued on Jan. 29.

In addition to Coincheck, the regulator has issued business improvement orders to Osaka-based Tech Bureau Corp., Tokyo-based GMO Coin Inc., Tokyo-based Bicrements Inc. and Fukuoka-based Mr. Exchange Inc.

In total, seven domestic cryptocurrency exchange operators have now been issued administrative sanctions, including the two that were issued business suspension orders.

The regulator found that the general manager of Bit Station’s corporate planning division, who holds 100 percent of the shares in the company, had diverted customers’ virtual currency for personal use. The regulator also said that FSHO did not have a proper system to monitor trading, even though some transactions were suspected to be used for money laundering.

The regulator judged that Coincheck lacked a proper management control system to protect customer assets and its virtual currency, which has high anonymity, could be possibly used for money laundering.

In total, seven domestic cryptocurrency exchange operators have now been issued administrative sanctions, including the two that were issued business suspension orders.

The regulator found that the general manager of Bit Station’s corporate planning division, who holds 100 percent of the shares in the company, had diverted customers’ virtual currency for personal use. The regulator also said that FSHO did not have a proper system to monitor trading, even though some transactions were suspected to be used for money laundering.

The regulator judged that Coincheck lacked a proper management control system to protect customer assets and its virtual currency, which has high anonymity, could be possibly used for money laundering.

- March 9, 2018

- Comment (0)

- Trackback(0)