Loading

Search

▼ Beer Brewery Firms Reviewing Strategies Ahead of Tax Reforms

- Category:Other

Beer brewery companies will likely review their business strategies in light of the decision by the ruling parties to integrate alcohol taxes on beer and beer-like beverages over the next 10 years as part of their outline for fiscal 2017 tax system reforms.

While taxes on beer products will be lowered, those on happoshu low-malt quasi-beer and third-segment beer-like alcoholic beverages — which retail for less than beer — will increase.

Beer brewery companies have made efforts to develop happoshu and third-segment beer-like beverages because they have been subject to lower taxes. Now, however, the companies appear to be changing business tactics.

Negative impacts

Domestic beer shipment volumes have been on a constant decline since peaking in 1994. Happoshu and third-segment beer-like beverages, which are cheaper than beer, have become more prevalent — accounting for 50 percent of the beer and beer-like products market.

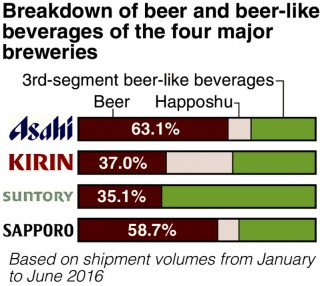

Kirin Brewery Co. and Suntory Beer Ltd. ship particularly high volumes of happoshu and third-segment beer-like beverages. At each firm, these drinks account for more than 60 percent of their total beer and beer-like products.

Because tax hikes on beer-like products may negatively impact earnings, the two companies have been speeding up measures, such as renewing brands and strengthening beer products, with an eye on the future tax hikes.

Positive impacts

Beer accounts for about 60 percent of total beer and beer-like product shipments at both Asahi Breweries Ltd. and Sapporo Breweries Ltd. Thus, it is assumed that the lower taxes will benefit these companies.

An industry source presented the view that “as much as 10 years is needed to realize the tax rate change because [the government] paid consideration to Kirin and Suntory.”

It is possible that sales competition will further intensify because Kirin and Suntory will have time to strengthen their beer-related businesses.

The definition of beer will also change from April 2018.

Many craft beers, which have become increasingly popular in recent years, contain fruits and spices. The tax system revisions aim to encourage the development of more kinds of these beers.

Some in the industry welcomed this. Naoyuki Ide, president of YO-HO Brewing Co., said, “It is the first step toward a big change.”

Cloudy consumer benefits

For consumers, it is unclear to what degree the beer tax cut will be beneficial.

About half of beer shipments go to dining and drinking establishments. Because the prices for draft and other types of beer served at restaurants and bars are determined by the operators, it is unclear if the reduced tax will be directly reflected in their prices.

An executive of a major beer brewery company voiced concern about the taxes on happoshu and third-segment beer-like beverages being raised:

“Consumers will choose to buy canned chuhai [shochu-based beverages] and other products that are cheaper than beer. As a result, there will be a tendency to not consume lots of beer.”

Beer accounts for about 60 percent of total beer and beer-like product shipments at both Asahi Breweries Ltd. and Sapporo Breweries Ltd. Thus, it is assumed that the lower taxes will benefit these companies.

An industry source presented the view that “as much as 10 years is needed to realize the tax rate change because [the government] paid consideration to Kirin and Suntory.”

It is possible that sales competition will further intensify because Kirin and Suntory will have time to strengthen their beer-related businesses.

The definition of beer will also change from April 2018.

Many craft beers, which have become increasingly popular in recent years, contain fruits and spices. The tax system revisions aim to encourage the development of more kinds of these beers.

Some in the industry welcomed this. Naoyuki Ide, president of YO-HO Brewing Co., said, “It is the first step toward a big change.”

Cloudy consumer benefits

For consumers, it is unclear to what degree the beer tax cut will be beneficial.

About half of beer shipments go to dining and drinking establishments. Because the prices for draft and other types of beer served at restaurants and bars are determined by the operators, it is unclear if the reduced tax will be directly reflected in their prices.

An executive of a major beer brewery company voiced concern about the taxes on happoshu and third-segment beer-like beverages being raised:

“Consumers will choose to buy canned chuhai [shochu-based beverages] and other products that are cheaper than beer. As a result, there will be a tendency to not consume lots of beer.”

- December 20, 2016

- Comment (0)

- Trackback(0)