Loading

Search

▼ Dollar at highest levels since 2007 against Japanese yen

- Category:Other

MARKETWATCH

The U.S. dollar shot even higher against the Japanese yen on Monday, hitting levels not seen since 2007. The dollar’s move higher against the yen comes in the wake of last week’s strong data out of the U.S. and a big stimulus package announced by Japan.

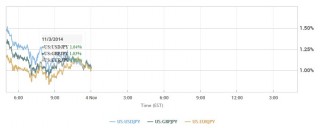

The dollar also traded near that seven-year yen high on Friday after unexpected stimulus from Japan. On Monday, the dollar USDJPY, -0.44% surged as much as 1.5% to before rising to ¥113.88 from ¥112.33 late Friday. Late Thursday, ahead of the Bank of Japan, the currency traded at ¥109.22.

Strategists are watching to see if the dollar takes out a major resistance level—¥114.02, hit in late December 2007.

Kit Juckes, global macro strategist at Société Générale, said in a note that now that the dollar has taken out ¥112.80, that opens a path to ¥115, and then the 2007 high above ¥123. “Adjust those levels for inflation and they make the yen look ludicrously cheap, but that’s not really relevant until the economy gets back on an even keel,” he said in a note.

An official gauge of China factory activity, released over the weekend, helped Influence currency levels. Data showed Chinese factory activity fell to a five-month low in October, suggesting more economic stimulus may be needed to spur the world’s largest (based on purchase-power parity) economy.

The yen also tumbled against the British pound GBPJPY, -0.30% , dropping 1.38% to ¥182.12 and the euro EURJPY, -0.13% , down 1.1% to ¥142.32.

The WSJ Dollar Index BUXX, -0.28% a measure of the dollar against a basket of major currencies, was down 0.02% to 79.39. The ICE Dollar Index DXY, -0.19% rose to 87.366 from 86.907

The euro EURUSD, +0.31% fell to $1.2485 from $1.2526 late Friday, breaking the Oct. 3 low of $1.2501, noted Christ Weston, chief market strategist at IG in a note.

“The fact the euro has also fallen relative to the yen and British pound (despite growing concerns from Angela Merkel about the U.K. leaving the EU) highlights the fact traders are now expecting some sort of retaliation from the ECB at this Thursday’s central bank meeting,” said Weston, though he added that’s probably unlikely, as the central bank will wait to see if the current round of measures will boost inflation expectations. Read: Don’t miss these 5 highlights in Europe this week

The British pound GBPUSD, +0.15% slipped to $1.5976 from $1.5999 late Friday, after manufacturing PMI for the U.K. beat expectations.

- November 4, 2014

- Comment (0)

- Trackback(0)