Loading

Search

▼ Half of Japan’s Senior Households Face Difficult Living Conditions

- Category:Other

The financial instability of post-retirement life has become a central issue in the upcoming House of Councillors election in Japan. Around half of the country’s senior households describe their own living conditions as “difficult.”

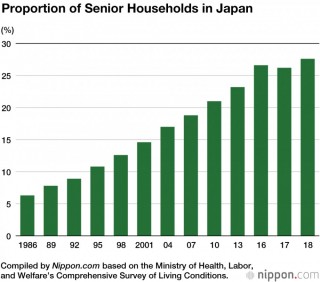

More than a quarter of Japanese households are headed by a person 65 years or older. A survey by the Ministry of Health, Labor, and Welfare found that, as of June 2018, there were 14.1 million such senior households, including those with unmarried members under 18 years of age. This amounts to 27.6% of all households in Japan, as compared to just 6.3% in 1986.

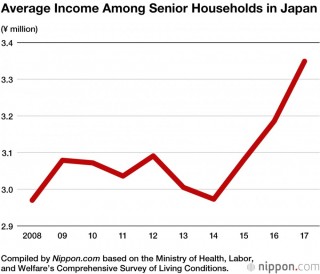

Average annual income for senior households set a new record of ¥3.349 million in 2017, the third consecutive annual increase. More than half of the income, or 61.1%, comes from pension payments. Meanwhile, 25.4% stemmed from wages in a current job, indicating how many seniors in Japan are continuing to work after retirement to supplement their incomes.

The survey did not include money accessed from savings, such as lump-sum retirement benefits. Among those surveyed in 2018, 55.1% described their living conditions as “difficult,” an increase over the 54.2% of the previous year.

Japan’s pension system suddenly became a central issue in the run-up to the July 21 House of Councillors election. This followed a controversy that arose in June when the Financial Services Agency issued a panel report predicting a ¥55,000 monthly shortfall between household income and expenditures among retired persons.

The survey did not include money accessed from savings, such as lump-sum retirement benefits. Among those surveyed in 2018, 55.1% described their living conditions as “difficult,” an increase over the 54.2% of the previous year.

Japan’s pension system suddenly became a central issue in the run-up to the July 21 House of Councillors election. This followed a controversy that arose in June when the Financial Services Agency issued a panel report predicting a ¥55,000 monthly shortfall between household income and expenditures among retired persons.

The report recommended that each household would need to save around ¥20 million to cover that difference over a 30-year post-retirement life. Prime Minister Abe Shinzō said it was misleading, and Finance Minister Asō Tarō said he would not use it as a reference. In response, opposition parties pursued the issue, putting the ruling party on the defensive.

The MHLW survey shed light not only on the financial difficulties of seniors but also their isolation, as reflected in the fact that nearly half of elderly persons, or 48.6%, are in single-person households.

The MHLW survey shed light not only on the financial difficulties of seniors but also their isolation, as reflected in the fact that nearly half of elderly persons, or 48.6%, are in single-person households.

- July 17, 2019

- Comment (0)

- Trackback(0)