Loading

Search

▼ For BOJ’s Kuroda, 2% Inflation Still a Long Way Off

- Category:Event

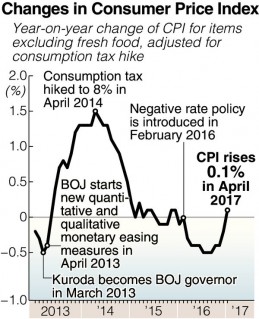

Although there is one year left before his term expires on April 8, 2018, Bank of Japan Gov. Haruhiko Kuroda still has a long way to go to realize his 2 percent inflation target. This is despite the bold monetary easing policies he has presented since taking office in March 2013.

During a lecture he gave in Tokyo on March 24, Kuroda stressed his intention to continue with monetary easing, saying, “Momentum for price increases remains, but it is not strong. The Bank of Japan will not upgrade its goal for managing long-term interest rates.”

Kuroda has continued with monetary easing over the past four years with the goal of boosting inflation to 2 percent.

However, falling crude oil prices and stagnating consumer spending left the rate of increase in the consumer price index at just 0.1 percent as of January.

Few observers believe Kuroda will achieve the 2 percent goal by the time his term expires. The governor will likely continue with his persistent monetary easing policy for the remainder of his term.

However, the inauguration of U.S. President Donald Trump has brought about big changes in the financial market, making it even harder for Kuroda to pursue his goal.

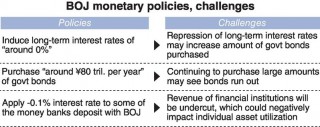

The Bank of Japan has made navigating long-term interest rates to “around zero percent ” a main pillar of its monetary policy. However, since Trump was elected in November, long-term interest rates in Japan and the United States have been facing upward pressure because investors are selling government bonds and buying stocks out of high expectations for his economic policies.

For now, the Bank of Japan can keep interest rates from rising using market adjustment methods it newly implemented, among other approaches. However, some observers believe the central bank will find it increasingly difficult to leave long-term interest rates unchanged, and will eventually have to hike them by the end of the year.

Will he continue?

There is also growing interest in who will succeed Kuroda.

During a lecture he gave in Tokyo on March 24, Kuroda stressed his intention to continue with monetary easing, saying, “Momentum for price increases remains, but it is not strong. The Bank of Japan will not upgrade its goal for managing long-term interest rates.”

Kuroda has continued with monetary easing over the past four years with the goal of boosting inflation to 2 percent.

However, falling crude oil prices and stagnating consumer spending left the rate of increase in the consumer price index at just 0.1 percent as of January.

Few observers believe Kuroda will achieve the 2 percent goal by the time his term expires. The governor will likely continue with his persistent monetary easing policy for the remainder of his term.

However, the inauguration of U.S. President Donald Trump has brought about big changes in the financial market, making it even harder for Kuroda to pursue his goal.

The Bank of Japan has made navigating long-term interest rates to “around zero percent ” a main pillar of its monetary policy. However, since Trump was elected in November, long-term interest rates in Japan and the United States have been facing upward pressure because investors are selling government bonds and buying stocks out of high expectations for his economic policies.

For now, the Bank of Japan can keep interest rates from rising using market adjustment methods it newly implemented, among other approaches. However, some observers believe the central bank will find it increasingly difficult to leave long-term interest rates unchanged, and will eventually have to hike them by the end of the year.

Will he continue?

There is also growing interest in who will succeed Kuroda.

When asked about the next governor during a meeting of the House of Councillors Budget Committee on Jan. 30, Prime Minister Shinzo Abe emphasized maintaining the same monetary policy.

“I have complete confidence in Gov. Kuroda’s monetary policy,” he said. “And I want to continue on the path he has established.”

Abe’s remarks have inspired many observers to expect Kuroda to continue his governorship because appointing a new one could be considered a change in the central bank’s policy.

However, Kuroda’s age is a concern. He will be 73 if reappointed, and would be 78 when he completes his term.

This is why the names of some BOJ senior officials have been regarded as possible successors, such as Deputy Gov. Hiroshi Nakaso and Executive Director Masayoshi Amamiya, who is in charge of the Monetary Affairs Department.

“I have complete confidence in Gov. Kuroda’s monetary policy,” he said. “And I want to continue on the path he has established.”

Abe’s remarks have inspired many observers to expect Kuroda to continue his governorship because appointing a new one could be considered a change in the central bank’s policy.

However, Kuroda’s age is a concern. He will be 73 if reappointed, and would be 78 when he completes his term.

This is why the names of some BOJ senior officials have been regarded as possible successors, such as Deputy Gov. Hiroshi Nakaso and Executive Director Masayoshi Amamiya, who is in charge of the Monetary Affairs Department.

Some have also hinted at Ambassador to Switzerland Etsuro Honda, who supports Abe’s economic policy; Financial Services Agency

Commissioner Nobuchika Mori, who is said to have close ties with the Prime Minister’s Office; and Columbia University Prof. Takatoshi Ito.

In July, the terms of Policy Board members Takehiro Sato and Takahide Kiuchi — who oppose the current monetary easing policy — will expire.

“Their successors, which are to be proposed by the government, will be a litmus test for the appointment of the next governor,” an economist said.

Commissioner Nobuchika Mori, who is said to have close ties with the Prime Minister’s Office; and Columbia University Prof. Takatoshi Ito.

In July, the terms of Policy Board members Takehiro Sato and Takahide Kiuchi — who oppose the current monetary easing policy — will expire.

“Their successors, which are to be proposed by the government, will be a litmus test for the appointment of the next governor,” an economist said.

- April 1, 2017

- Comment (0)

- Trackback(0)