Loading

Search

▼ Global Economy / China’s New Central Bank Gov. Faces Bumpy Road

- Category:Event

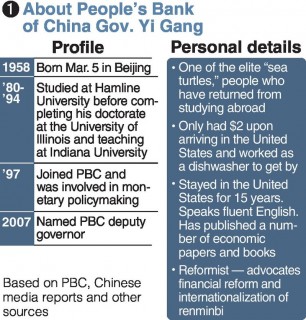

Yi Gang has been appointed governor of China’s central bank, the People’s Bank of China (PBC). He is the first “sea turtle” (see below) to become chief of the country’s central bank. The question is whether he will be able to accelerate the reform and opening-up of China’s financial realm and take on the mantle of “Mr. Renminbi” — a figure synonymous with China’s currency.

The decision to promote Yi, the then deputy governor of the PBC, to the top spot received favorable coverage from numerous foreign media outlets soon after it was announced at the National People’s Congress on March 19. Yi was lauded as “a U.S.-trained economist” and “an expert on monetary policy.”

So what kind of person is Yi?

Born in 1958, Yi is 60 years old. After studying economics at the prestigious Peking University, he went to the United States in 1980. He was among the first generation of Chinese people to study abroad in the United States.

After working his way through school, Yi earned a PhD in economics from the University of Illinois. He then moved to Indiana University, where he taught for about eight years. He is a monetary policy expert with a number of English-language economics papers to his name.

Although Yi earned a tenured position as a lecturer at a U.S. university, in 1994 he changed jobs to become a professor at the Peking University China Center for Economic Research. He entered the PBC in 1997 and became its deputy governor in 2007, providing support to the previous governor, Zhou Xiaochuan, who came from China’s government bureaucracy.

Yi is recognized as a reformist, a man with practical experience despite a scholarly background.

“Mr. Yi is proficient in English, and someone who can share an awareness of the issues because he’s in the same ring as central bank governors from other countries,” said Naoto Saito, a chief researcher at the Daiwa Institute of Research Ltd.

On March 25, Yi took the stage publicly for the first time since being appointed governor at a forum in Beijing, and emphasized expanding the opening-up of the financial industry and improving competitiveness. He showed his intention to steadily advance reform of the financial sector.

Interaction with markets

Still, it is hard to predict whether Yi will come to be called “Mr. Renminbi,” as his predecessor Zhou was known.

In 2016, the RMB was added to the International Monetary Fund’s basket of currencies with special drawing rights (see below). The IMF’s recognition of the RMB as an international currency was a symbolic event that enhanced Zhou’s reputation.

Yi is recognized as a reformist, a man with practical experience despite a scholarly background.

“Mr. Yi is proficient in English, and someone who can share an awareness of the issues because he’s in the same ring as central bank governors from other countries,” said Naoto Saito, a chief researcher at the Daiwa Institute of Research Ltd.

On March 25, Yi took the stage publicly for the first time since being appointed governor at a forum in Beijing, and emphasized expanding the opening-up of the financial industry and improving competitiveness. He showed his intention to steadily advance reform of the financial sector.

Interaction with markets

Still, it is hard to predict whether Yi will come to be called “Mr. Renminbi,” as his predecessor Zhou was known.

In 2016, the RMB was added to the International Monetary Fund’s basket of currencies with special drawing rights (see below). The IMF’s recognition of the RMB as an international currency was a symbolic event that enhanced Zhou’s reputation.

However, Yi is expected to achieve more than such a reputation. The hope is that he will advance substantial reforms.

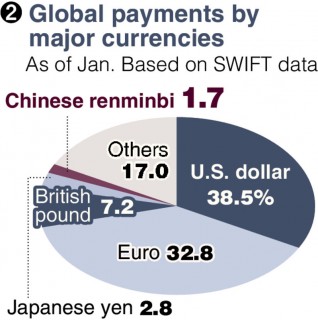

According to the Society for Worldwide Interbank Financial Telecommunication (SWIFT), as of January 2018, the RMB is used worldwide at a rate of only about 1.7 percent. For the past several years, the RMB’s usage rate has been on a downward trajectory. The global economy is in effect saying, “The RMB is not an easy currency to use.”

There are several reasons for this.

Zhou held few press conferences, and hardly ever publicly explained the intentions behind policy changes. To prevent capital outflows from China, he placed restrictions on overseas remittances and capital transactions. Many pointed out the limits to such an approach.

Normally, central banks carefully explain the aims of their monetary policies in statements, with governors holding regular press conferences. This is to boost transparency in policy making, which affects people’s livelihoods, and avoid causing excessive shock to markets.

A trilemma

But there is still another challenge: the trilemma of international finance, a concept in economic theory.

According to the Society for Worldwide Interbank Financial Telecommunication (SWIFT), as of January 2018, the RMB is used worldwide at a rate of only about 1.7 percent. For the past several years, the RMB’s usage rate has been on a downward trajectory. The global economy is in effect saying, “The RMB is not an easy currency to use.”

There are several reasons for this.

Zhou held few press conferences, and hardly ever publicly explained the intentions behind policy changes. To prevent capital outflows from China, he placed restrictions on overseas remittances and capital transactions. Many pointed out the limits to such an approach.

Normally, central banks carefully explain the aims of their monetary policies in statements, with governors holding regular press conferences. This is to boost transparency in policy making, which affects people’s livelihoods, and avoid causing excessive shock to markets.

A trilemma

But there is still another challenge: the trilemma of international finance, a concept in economic theory.

The trilemma of international finance holds that three policies — (a) stability in exchange rates; (b) free flow of capital; and (c) autonomy of monetary policies — cannot be achieved simultaneously. Also called the “impossible trinity,” it points to the necessity of sacrificing one of the policies.

China wants to maintain stability in exchange rates.

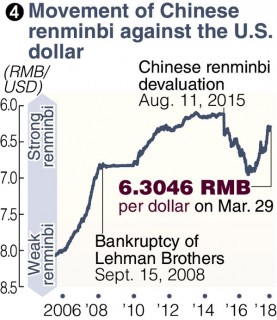

To do so, the country has introduced its own “managed float” regime. Although easily misunderstood because it involves fluctuations, the system involves monetary authorities deciding standard values for daily transactions and “managing” in order to keep prices within a set range. A look at changes in the market price of the RMB reveals unnaturally straight lines after the Lehman shock in 2008 and the renminbi devaluation in 2015.

China also wants to maintain autonomy in monetary policies (c) and avoid surrendering its own policies as it advances economic policies. To do so, it is limiting the free flow of capital (b) by restricting overseas remittances and companies’ capital transactions.

However, the caps on investment ratios employed in a number of industries have a bad reputation with foreign firms. Chinese firms hoping to acquire foreign companies also appear to be dissatisfied with them. To resolve the problem, China has to abandon either monetary policy (a) or (c). The country seems caught in the horns of the trilemma of international finance.

Weight of a ‘boss’

The unique placement of the PBC is also a hurdle.

In advanced nations, the central bank’s independence from the government is guaranteed under law. The PBC, however, is part of the Chinese government, and not independent. The PBC governorship is a ministerial level post.

Moreover, Yi, a “sea turtle” with extensive experience living abroad, has low status in the Communist Party of China.

Public offices and businesses in China are required to have a Communist Party unit. The PBC’s deputy governor Guo Shuqing (chairman of the China Banking Regulatory Commission) took the top spot as secretary of the bank’s Communist Party unit, and Yi became deputy secretary. The hierarchy of the PBC and Communist Party organization has thus become distorted.

And within the party hierarchy is a “boss” still higher — vice premier Liu He, general secretary Xi Jinping’s economic guru. The Xi-Liu axis appears to be deciding important economic policies.

It seems highly likely that Yi will become a “practical mind who carries out decisions made at the top,” according to SMBC Nikko Securities senior economist Xiao Minjie.

Despite this, Yi will be one of the “faces” of China at international conferences. He will be expected to use his abundant overseas experience to focus on interacting with markets and ensure the “RMB shock” that shook financial markets is not repeated, and to minimize confusion in the reform and opening-up of China’s closed monetary markets.

■ Sea turtle

Chinese expression for elite individuals who have returned to China after studying abroad. It comes from the fact that the word for sea turtle is pronounced the same way as that for returnees from overseas.

■ Special drawing rights

An international reserve asset allotted by the IMF according to member countries’ investment ratios. Comprised of five currencies — the U.S.

dollar, euro, the British pound, the Japanese yen and the RMB. If foreign currencies used for trade payments and other purposes are short due to a financial crisis or other reason, a member country can obtain SDR currencies, such as the U.S. dollar, in exchange for handing over allotted SDR to another member country.

China wants to maintain stability in exchange rates.

To do so, the country has introduced its own “managed float” regime. Although easily misunderstood because it involves fluctuations, the system involves monetary authorities deciding standard values for daily transactions and “managing” in order to keep prices within a set range. A look at changes in the market price of the RMB reveals unnaturally straight lines after the Lehman shock in 2008 and the renminbi devaluation in 2015.

China also wants to maintain autonomy in monetary policies (c) and avoid surrendering its own policies as it advances economic policies. To do so, it is limiting the free flow of capital (b) by restricting overseas remittances and companies’ capital transactions.

However, the caps on investment ratios employed in a number of industries have a bad reputation with foreign firms. Chinese firms hoping to acquire foreign companies also appear to be dissatisfied with them. To resolve the problem, China has to abandon either monetary policy (a) or (c). The country seems caught in the horns of the trilemma of international finance.

Weight of a ‘boss’

The unique placement of the PBC is also a hurdle.

In advanced nations, the central bank’s independence from the government is guaranteed under law. The PBC, however, is part of the Chinese government, and not independent. The PBC governorship is a ministerial level post.

Moreover, Yi, a “sea turtle” with extensive experience living abroad, has low status in the Communist Party of China.

Public offices and businesses in China are required to have a Communist Party unit. The PBC’s deputy governor Guo Shuqing (chairman of the China Banking Regulatory Commission) took the top spot as secretary of the bank’s Communist Party unit, and Yi became deputy secretary. The hierarchy of the PBC and Communist Party organization has thus become distorted.

And within the party hierarchy is a “boss” still higher — vice premier Liu He, general secretary Xi Jinping’s economic guru. The Xi-Liu axis appears to be deciding important economic policies.

It seems highly likely that Yi will become a “practical mind who carries out decisions made at the top,” according to SMBC Nikko Securities senior economist Xiao Minjie.

Despite this, Yi will be one of the “faces” of China at international conferences. He will be expected to use his abundant overseas experience to focus on interacting with markets and ensure the “RMB shock” that shook financial markets is not repeated, and to minimize confusion in the reform and opening-up of China’s closed monetary markets.

■ Sea turtle

Chinese expression for elite individuals who have returned to China after studying abroad. It comes from the fact that the word for sea turtle is pronounced the same way as that for returnees from overseas.

■ Special drawing rights

An international reserve asset allotted by the IMF according to member countries’ investment ratios. Comprised of five currencies — the U.S.

dollar, euro, the British pound, the Japanese yen and the RMB. If foreign currencies used for trade payments and other purposes are short due to a financial crisis or other reason, a member country can obtain SDR currencies, such as the U.S. dollar, in exchange for handing over allotted SDR to another member country.

- April 16, 2018

- Comment (0)

- Trackback(0)