Loading

Search

▼ New Year to Herald Price Hikes for Daily Living

- Category:Event

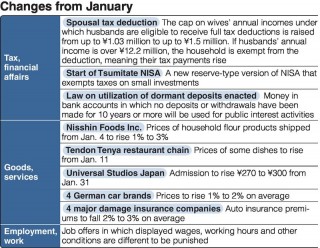

Some systems and schemes closely related to daily living will change starting in January 2018, and the prices of various goods and services such as imported cars and some types of foods are set to rise.

Taxes for married couples will rise or fall in accordance with their annual incomes. A government scheme to render profits from investment trust funds as tax-exempt will be expanded.

Currently, a spousal tax deduction system for reducing income taxes on households in which the wives are homemakers or part-time workers is applied if the wife’s annual income is ¥1.03 million or less. The taxable income of husbands in such household is calculated after deducting a standard amount of ¥380,000.

From January, the annual income cap for wives in those households will be raised from ¥1.03 million to ¥1.5 million so that husbands can continue to receive the full deduction of ¥380,000.

If a wife’s annual income exceeds ¥1.5 million, the husband’s taxable income deduction is lowered proportionately. Husbands will be eligible for the taxable income deduction if their wives’ incomes are not more than ¥2.01 million.

However, the spousal tax deduction system will not be applied to households in which the husband’s annual income is over ¥12.2 million.

As a result of the changes, taxes will fall for about 3 million households and rise for about 1 million households.

An expanded version of NISA — a scheme that renders profits from relatively small investments in trust funds and other financial products as exempt from tax — is also set to begin.

Under the new Tsumitate NISA scheme, relevant investments will be tax-exempt for the first 20 years, on the condition that no more than ¥400,000 is invested per year.

NISA is a Japanese version of an individual savings account. Usually, a 20 percent tax is imposed on profits from investments in financial products, but those made using NISA are exempt. The tax exemption is applied to profits from sales and dividends of investment trust funds that are judged to meet criteria set by the Financial Services Agency.

Under the conventional NISA scheme, such profits are tax-exempt for five years, on the condition no more than ¥1.2 million is invested per year. Concurrently holding a conventional NISA and Tsumitate NISA is prohibited.

The law on the utilization of dormant deposits will also be enacted. The law is for using money in accounts at banks and other financial institutions into which no deposits or withdrawals have been made for 10 years or more. The money will be used to promote public interest activities. Financial institutions would still accept depositors’ requests for withdrawals from the accounts.

Nisshin Foods Inc. will raise the prices of household flour shipped from Jan. 4 by 1 percent to 3 percent.

Tendon Tenya, a restaurant chain selling tempura-topped bowls of rice, will raise the prices of some of its dishes from Jan. 11.

The Universal Studios Japan theme park will raise its admission fees by ¥270 to ¥300 from Jan. 31. One-day tickets will be priced at ¥7,900 for adults (junior high school students and older), including consumption tax.

The prices of four German car brands, including Mercedes-Benz, will rise from Jan. 1.

Auto insurance premiums will be lowered — those of Mitsui Sumitomo Insurance Co. and Aioi Nissay Dowa Insurance Co. will fall 3 percent on average, while those of Tokio Marine & Nichido Fire Insurance Co. will fall 2.8 percent on average. Those of Sompo Japan Nipponkoa Insurance Inc. will fall 2 percent on average.

Regulations will also be toughened on companies that post job offers containing false information about working conditions.

Taxes for married couples will rise or fall in accordance with their annual incomes. A government scheme to render profits from investment trust funds as tax-exempt will be expanded.

Currently, a spousal tax deduction system for reducing income taxes on households in which the wives are homemakers or part-time workers is applied if the wife’s annual income is ¥1.03 million or less. The taxable income of husbands in such household is calculated after deducting a standard amount of ¥380,000.

From January, the annual income cap for wives in those households will be raised from ¥1.03 million to ¥1.5 million so that husbands can continue to receive the full deduction of ¥380,000.

If a wife’s annual income exceeds ¥1.5 million, the husband’s taxable income deduction is lowered proportionately. Husbands will be eligible for the taxable income deduction if their wives’ incomes are not more than ¥2.01 million.

However, the spousal tax deduction system will not be applied to households in which the husband’s annual income is over ¥12.2 million.

As a result of the changes, taxes will fall for about 3 million households and rise for about 1 million households.

An expanded version of NISA — a scheme that renders profits from relatively small investments in trust funds and other financial products as exempt from tax — is also set to begin.

Under the new Tsumitate NISA scheme, relevant investments will be tax-exempt for the first 20 years, on the condition that no more than ¥400,000 is invested per year.

NISA is a Japanese version of an individual savings account. Usually, a 20 percent tax is imposed on profits from investments in financial products, but those made using NISA are exempt. The tax exemption is applied to profits from sales and dividends of investment trust funds that are judged to meet criteria set by the Financial Services Agency.

Under the conventional NISA scheme, such profits are tax-exempt for five years, on the condition no more than ¥1.2 million is invested per year. Concurrently holding a conventional NISA and Tsumitate NISA is prohibited.

The law on the utilization of dormant deposits will also be enacted. The law is for using money in accounts at banks and other financial institutions into which no deposits or withdrawals have been made for 10 years or more. The money will be used to promote public interest activities. Financial institutions would still accept depositors’ requests for withdrawals from the accounts.

Nisshin Foods Inc. will raise the prices of household flour shipped from Jan. 4 by 1 percent to 3 percent.

Tendon Tenya, a restaurant chain selling tempura-topped bowls of rice, will raise the prices of some of its dishes from Jan. 11.

The Universal Studios Japan theme park will raise its admission fees by ¥270 to ¥300 from Jan. 31. One-day tickets will be priced at ¥7,900 for adults (junior high school students and older), including consumption tax.

The prices of four German car brands, including Mercedes-Benz, will rise from Jan. 1.

Auto insurance premiums will be lowered — those of Mitsui Sumitomo Insurance Co. and Aioi Nissay Dowa Insurance Co. will fall 3 percent on average, while those of Tokio Marine & Nichido Fire Insurance Co. will fall 2.8 percent on average. Those of Sompo Japan Nipponkoa Insurance Inc. will fall 2 percent on average.

Regulations will also be toughened on companies that post job offers containing false information about working conditions.

- January 4, 2018

- Comment (0)

- Trackback(0)