Loading

Search

▼ Kanebo Remnant Still Faces Issues Decade After Scandal

- Category:Event

This July marks 10 years since Kracie Holdings Ltd. was established to take over the business operations of Kanebo Ltd.’s failed daily products and other divisions.

Kracie’s results have been improving thanks to the release of hit hair care products and other items. However, for the company to reach the next level of growth, it needs to solve many issues including how to enhance cooperation among its internal business units.

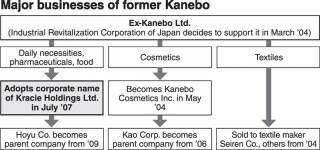

Kanebo, a former giant corporate group that dealt with a wide range of products from textiles to cosmetics, was dissolved after its de facto collapse. Among its major businesses, the cosmetics operation was sold to Kao Corp., and the textile operation to Seiren Co. and other companies.

Kracie was established in 2007 and took over Kanebo’s operations in daily products, pharmaceuticals and foods. Kracie is currently the wholly owned subsidiary of parent company Hoyu Co., which is known for hair-coloring products.

Kracie’s last 10 years can hardly be called stable. Its consolidated net sales in fiscal 2007, just after the establishment of the company, were ¥74.5 billion, only one-seventh of Kanebo’s. The new company was slow to raise its awareness, and its operating profit, or profits made by the company’s regular businesses, was in the red in fiscal 2009 and 2010.

However, its “Ichikami” hair-care products became a hit, opening a path for the company’s revival. Kracie had a limited advertising budget compared to its more financially powerful competitors. The company decided to adopt the low-key strategy of handing out up to 5 million sample products a year. Its efforts have gradually paid off.

Company towns hurt

Kanebo’s rise and fall affected its “company towns” across Japan.

A factory in Takaoka, Toyama Prefecture, where Kracie Pharma Ltd. currently manufactures Chinese medicines, provided jobs for about 1,500 workers when Kanebo started its spinning business in 1941. Now only about 200 work there. The factory shifted operations from the spinning to the pharmaceutical industry in 1992, after losing ground to foreign products due to appreciation of the yen and other factors.

Kracie’s results have been improving thanks to the release of hit hair care products and other items. However, for the company to reach the next level of growth, it needs to solve many issues including how to enhance cooperation among its internal business units.

Kanebo, a former giant corporate group that dealt with a wide range of products from textiles to cosmetics, was dissolved after its de facto collapse. Among its major businesses, the cosmetics operation was sold to Kao Corp., and the textile operation to Seiren Co. and other companies.

Kracie was established in 2007 and took over Kanebo’s operations in daily products, pharmaceuticals and foods. Kracie is currently the wholly owned subsidiary of parent company Hoyu Co., which is known for hair-coloring products.

Kracie’s last 10 years can hardly be called stable. Its consolidated net sales in fiscal 2007, just after the establishment of the company, were ¥74.5 billion, only one-seventh of Kanebo’s. The new company was slow to raise its awareness, and its operating profit, or profits made by the company’s regular businesses, was in the red in fiscal 2009 and 2010.

However, its “Ichikami” hair-care products became a hit, opening a path for the company’s revival. Kracie had a limited advertising budget compared to its more financially powerful competitors. The company decided to adopt the low-key strategy of handing out up to 5 million sample products a year. Its efforts have gradually paid off.

Company towns hurt

Kanebo’s rise and fall affected its “company towns” across Japan.

A factory in Takaoka, Toyama Prefecture, where Kracie Pharma Ltd. currently manufactures Chinese medicines, provided jobs for about 1,500 workers when Kanebo started its spinning business in 1941. Now only about 200 work there. The factory shifted operations from the spinning to the pharmaceutical industry in 1992, after losing ground to foreign products due to appreciation of the yen and other factors.

In Takaoka, the plant is still called the “Kanebo factory.” A 65-year-old man who joined the factory in 1971 now works there as a non-regular employee. “Kracie can be said to be reborn only when the community starts relying on it,” he said.

Kracie’s consolidated net sales in fiscal 2016 were ¥91.4 billion, up about 20 percent from fiscal 2007, and its operating profit was ¥5.4 billion in the black.

Kracie Holdings President Yasuya Ishibashi told reporters on June 14 in Tokyo, “We’ve finally become an ordinary company after 10 years.”

However, it is said that each Kracie operation tends to be independent. A person connected to the company said, “A growth business capable of leading the entire company has yet to emerge.”

Kracie is being called on to launch full-scale efforts in high-growth fields such as health.

Lingering ‘blotch’ issue

Kanebo’s cosmetics operation was broken off as Kanebo Cosmetics Inc. in 2004, and Kao bought it for about ¥400 billion in 2006. Trademark rights and other holdings of Kanebo were transferred to Kanebo Cosmetics.

Kanebo Cosmetics worked with parent company Kao to strengthen sales, but lost ground over a “white blotch” issue that came to light in 2013, leaving the company stalled on the path to recovery.

The issue involved its cosmetics leaving white blotches or uneven tones on the wearer’s skin. The number of people affected reached about 19,600, and more than 7,000 still bear the effects on their skin.

The company established a special department to deal with the matter and has reached a settlement with more than 17,000 people. But negotiations with about 2,000 others have yet to be resolved.

The issue affected the company’s performance. Kanebo Cosmetics posted a loss of nearly ¥20 billion over the three years from fiscal 2013 to fiscal 2015 due to compensation payments and other expenses.

A security analyst said: “[Kanebo Cosmetics] has fallen behind its competitors in the skin care field. How the company will overcome differences with Kao in corporate climate and get back into shape is crucial.”

Kracie’s consolidated net sales in fiscal 2016 were ¥91.4 billion, up about 20 percent from fiscal 2007, and its operating profit was ¥5.4 billion in the black.

Kracie Holdings President Yasuya Ishibashi told reporters on June 14 in Tokyo, “We’ve finally become an ordinary company after 10 years.”

However, it is said that each Kracie operation tends to be independent. A person connected to the company said, “A growth business capable of leading the entire company has yet to emerge.”

Kracie is being called on to launch full-scale efforts in high-growth fields such as health.

Lingering ‘blotch’ issue

Kanebo’s cosmetics operation was broken off as Kanebo Cosmetics Inc. in 2004, and Kao bought it for about ¥400 billion in 2006. Trademark rights and other holdings of Kanebo were transferred to Kanebo Cosmetics.

Kanebo Cosmetics worked with parent company Kao to strengthen sales, but lost ground over a “white blotch” issue that came to light in 2013, leaving the company stalled on the path to recovery.

The issue involved its cosmetics leaving white blotches or uneven tones on the wearer’s skin. The number of people affected reached about 19,600, and more than 7,000 still bear the effects on their skin.

The company established a special department to deal with the matter and has reached a settlement with more than 17,000 people. But negotiations with about 2,000 others have yet to be resolved.

The issue affected the company’s performance. Kanebo Cosmetics posted a loss of nearly ¥20 billion over the three years from fiscal 2013 to fiscal 2015 due to compensation payments and other expenses.

A security analyst said: “[Kanebo Cosmetics] has fallen behind its competitors in the skin care field. How the company will overcome differences with Kao in corporate climate and get back into shape is crucial.”

- July 18, 2017

- Comment (0)

- Trackback(0)