Loading

Search

▼ Japan’s MUFG — Finding A Sense Of Unity Amid Financial Change

- Category:Other

The digitization of financial transactions has empowered start-ups that can provide payment and other digital services. The Yomiuri Shimbun interviewed Hironori Kamezawa, president and group CEO of Mitsubishi UFJ Financial Group Inc. (MUFG), about how the group is responding to rapid changes in the business environment.

■ Moment of success

The coronavirus crisis has made online meetings more common, enabling me to meet many people at one time over great distances. In July, we held a town hall-type meeting in cyberspace with 500 employees from our group’s bank, trust bank and securities companies in Japan.

I asked the participants to come up with questions on the spot. I answered in order of the questions that got the most thumbs up, and sometimes asked them questions in return so as to understand the intention behind their query. I was asked many things, such as “Do you, the president, enjoy your work?” and “How shall we change?” It was fun, as I could directly find out our employees’ interests.

Since I became CEO in April, I’ve held a series of online discussions with young employees from our group companies. I talked frankly about my private life and actively exchanged opinions about our business with them.

I’ll continue to use the internet to communicate with our employees, and I’ve asked the other executives to take a similar approach. It’s important that employees have a greater sense of participating in management and can feel an affinity with the MUFG’s raison d’etre. I want to make this group attractive enough that employees enjoy working everyday and find their job rewarding. I’m advocating a type of management that focuses on “engagement,” which refers to employees having confidence in the company and the desire to voluntarily contribute.

We are implementing other specific measures as well. For example, we plan to have open discussions with experts from outside the group, in which our employees also participate, and to establish an in-house venture system. We are trying to shrink the distance between management and employees to create an organization in which employees can propose any idea they have.

I’ve had many opportunities to be involved in the launch of new businesses and have often been transferred to a department without a predecessor. The experience of building a team from scratch each time is the foundation of my engagement-oriented management.

Kamezawa joined MUFG in 1986, around the time of drastic financial liberalization.

In my third year, I was assigned to prepare for the lifting of a ban on securities options transactions. Through the introduction of a trading system and the establishment of a market framework, I gradually gained more colleagues.

It was hard to determine what we should do in the beginning, but by making mistakes over and over, we began to share feelings like “this is our goal.” That was the moment when I felt like it was getting exciting and that we would do well.

Once a team can create a situation in which they share a common goal, they can boost their team strength and make ideas a reality. I was able to learn this philosophy early in my career.

■ Moment of success

The coronavirus crisis has made online meetings more common, enabling me to meet many people at one time over great distances. In July, we held a town hall-type meeting in cyberspace with 500 employees from our group’s bank, trust bank and securities companies in Japan.

I asked the participants to come up with questions on the spot. I answered in order of the questions that got the most thumbs up, and sometimes asked them questions in return so as to understand the intention behind their query. I was asked many things, such as “Do you, the president, enjoy your work?” and “How shall we change?” It was fun, as I could directly find out our employees’ interests.

Since I became CEO in April, I’ve held a series of online discussions with young employees from our group companies. I talked frankly about my private life and actively exchanged opinions about our business with them.

I’ll continue to use the internet to communicate with our employees, and I’ve asked the other executives to take a similar approach. It’s important that employees have a greater sense of participating in management and can feel an affinity with the MUFG’s raison d’etre. I want to make this group attractive enough that employees enjoy working everyday and find their job rewarding. I’m advocating a type of management that focuses on “engagement,” which refers to employees having confidence in the company and the desire to voluntarily contribute.

We are implementing other specific measures as well. For example, we plan to have open discussions with experts from outside the group, in which our employees also participate, and to establish an in-house venture system. We are trying to shrink the distance between management and employees to create an organization in which employees can propose any idea they have.

I’ve had many opportunities to be involved in the launch of new businesses and have often been transferred to a department without a predecessor. The experience of building a team from scratch each time is the foundation of my engagement-oriented management.

Kamezawa joined MUFG in 1986, around the time of drastic financial liberalization.

In my third year, I was assigned to prepare for the lifting of a ban on securities options transactions. Through the introduction of a trading system and the establishment of a market framework, I gradually gained more colleagues.

It was hard to determine what we should do in the beginning, but by making mistakes over and over, we began to share feelings like “this is our goal.” That was the moment when I felt like it was getting exciting and that we would do well.

Once a team can create a situation in which they share a common goal, they can boost their team strength and make ideas a reality. I was able to learn this philosophy early in my career.

■ Ready for bad news

Kamezawa was in charge of a credit policy and planning department when the company was hit by the 2008 collapse of Lehman Brothers and the 2011 Great East Japan Earthquake.

We were forced to increase reserves to prepare for loan losses and to reduce our securities holdings, which directly led to management problems. I had a hard time as a manager in charge.

However, I was advised by my boss at the time: “The power of an organization is tested when times get tough. Just think it over and look forward with confidence.” Therefore I tried to convey my best measures without hesitation. I was often berated, but I think they listened to me.

Since then, as my position has risen, I have tried to make sure that my subordinates convey bad information to me.

MUFG owns Union Bank, a major U.S. regional bank.

I became a deputy chief executive officer for the Americas in New York at the start of the integrated management of the MUFG’s local branch there and Union Bank. At the age of 53, I was posted abroad for the first time.

Soon after that, an American chief risk officer resigned, and I was suddenly appointed as his successor. I was in a position to directly manage a staff of about 2,500 or so Americans. I wasn’t confident in my language ability, and it was all a bolt from the blue.

Local staffers would suddenly come into my room and start to explain something in English. I often had to start with “Wait, wait. Who are you?” before listening to what the person had to say. Then I talked with the person and learned they had come to seek suggestions without doing any groundwork.

Their approach was “I’m here to get your approval before explaining it to everyone.” This was a quite different approach from the Japanese way of working, and it was really tough for me to get used to.

I tried to not just sit and wait in my executive room, but to instead go to the staff as much as possible. As I talked with them in person, I could receive more proposals and help from them.

At board meetings, there was verbal sparring — which almost never happens in Japan — that lasted for a long time. I keenly felt the differences in the way work is done, in the values and culture. It opened my eyes in many ways.

Kamezawa was in charge of a credit policy and planning department when the company was hit by the 2008 collapse of Lehman Brothers and the 2011 Great East Japan Earthquake.

We were forced to increase reserves to prepare for loan losses and to reduce our securities holdings, which directly led to management problems. I had a hard time as a manager in charge.

However, I was advised by my boss at the time: “The power of an organization is tested when times get tough. Just think it over and look forward with confidence.” Therefore I tried to convey my best measures without hesitation. I was often berated, but I think they listened to me.

Since then, as my position has risen, I have tried to make sure that my subordinates convey bad information to me.

MUFG owns Union Bank, a major U.S. regional bank.

I became a deputy chief executive officer for the Americas in New York at the start of the integrated management of the MUFG’s local branch there and Union Bank. At the age of 53, I was posted abroad for the first time.

Soon after that, an American chief risk officer resigned, and I was suddenly appointed as his successor. I was in a position to directly manage a staff of about 2,500 or so Americans. I wasn’t confident in my language ability, and it was all a bolt from the blue.

Local staffers would suddenly come into my room and start to explain something in English. I often had to start with “Wait, wait. Who are you?” before listening to what the person had to say. Then I talked with the person and learned they had come to seek suggestions without doing any groundwork.

Their approach was “I’m here to get your approval before explaining it to everyone.” This was a quite different approach from the Japanese way of working, and it was really tough for me to get used to.

I tried to not just sit and wait in my executive room, but to instead go to the staff as much as possible. As I talked with them in person, I could receive more proposals and help from them.

At board meetings, there was verbal sparring — which almost never happens in Japan — that lasted for a long time. I keenly felt the differences in the way work is done, in the values and culture. It opened my eyes in many ways.

■ Believing in intuition

Until now, the top executives of megabanks were all liberal arts majors, many of whom had job experience in personnel and corporate planning departments.

I studied mathematics at university and graduate school. It’s a lie to say I’m not conscious of being called the “first science major president,” but I don’t think being a science major helps in business. I may think of things logically, but I tend to judge more intuitively. Rather, I’m more committed to the idea of “I have to do what I have to do.”

After returning to Japan, I served as an executive in the system and digital divisions, and people say I have an unusual background. But again, it’s no use being conscious of that, either.

However, given the digitization of society today, taking charge of those departments was a good experience. The coronavirus will further accelerate this trend. I am grateful I can work in changing times.

Digitization is making our operations more efficient, but finding new sources of revenue is not easy. It’s important to try first, and if you fail, you should stop right there and reevaluate. We need to repeat this process.

In the years to come, the experiences of the generation of experts, including me, may not always be right. We have to find the next step through discussions with young people, who have new ideas. I value a “natural posture,” which is my motto.

As the coronavirus spreads, I felt anew the responsibility and role of financial institutions, which play a vital role as the bloodstream of the economy. I want our group to be strong and trusted at all times. To that end, I want to make the group a bright place with energetic employees.

Kamezawa was born in Miyazaki Prefecture in 1961. He has a master’s degree in number theory from the University of Tokyo. In 1986 he joined the Mitsubishi Bank Ltd. (currently MUFG Bank Ltd.) and became deputy president of MUFG Bank and Mitsubishi UFJ Financial Group, Inc. in April 2019 before beginning to serve in his current post in April this year.

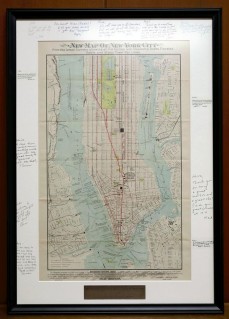

Kamezawa was transferred to the United States for two years, and when he returned to Japan, he got a map of New York from 12 local executives as a gift. It’s an old map of Manhattan before the bridges were built, with messages from each colleague written in the margins.

The map is placed in Kamezawa’s office for him to occasionally look back on his time there.

“It was hard, but I grew a lot,” he recalled adding, “I feel uneasy, too.”

- September 11, 2020

- Comment (0)

- Trackback(0)