Loading

Search

▼ Investors Flock to Corporate, Local Government Bonds

- Category:Other

By Shota Mizuno and Masaomi Shimosato / Yomiuri Shimbun Staff Writers

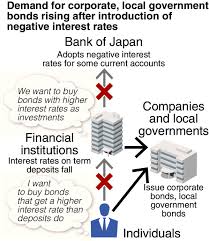

Corporate bonds and local government bonds have become a magnet for investors since the Bank of Japan decided in late January to adopt negative interest rates.

The bonds issued by private companies and local governments are drawing investors by retaining positive interest rates at a time when the yield on 10-year government bonds is becoming entrenched in negative territory. Some companies are even increasing the value of new issuances due to the lower amount of interest they will have to pay.

In late February, West Japan Railway Co. became the first private company to issue 40-year corporate bonds. The bonds have a 1.575 percent coupon. Conventionally, the longer the maturity period, the greater the risk the principal will not return. However, there was insatiable demand among investors for the bonds, which were oversubscribed at a level nearly three times the issuance value.

In March, Ajinomoto Co. will increase the issuance value of bonds targeting institutional investors from the initial ¥50 billion to ¥70 billion.

“We realized that demand was high due to the central bank’s negative interest rates, so we increased the issuance of our bonds,” an Ajinomoto representative said.

Corporate bonds are gaining popularity because the yield from government bonds is plunging due to the Bank of Japan’s introduction of negative interest rates. On Feb. 9, the yield on 10-year government bonds dipped below zero for the first time. The gap between yields is continuing to widen.

Corporate bonds and local government bonds have become a magnet for investors since the Bank of Japan decided in late January to adopt negative interest rates.

The bonds issued by private companies and local governments are drawing investors by retaining positive interest rates at a time when the yield on 10-year government bonds is becoming entrenched in negative territory. Some companies are even increasing the value of new issuances due to the lower amount of interest they will have to pay.

In late February, West Japan Railway Co. became the first private company to issue 40-year corporate bonds. The bonds have a 1.575 percent coupon. Conventionally, the longer the maturity period, the greater the risk the principal will not return. However, there was insatiable demand among investors for the bonds, which were oversubscribed at a level nearly three times the issuance value.

In March, Ajinomoto Co. will increase the issuance value of bonds targeting institutional investors from the initial ¥50 billion to ¥70 billion.

“We realized that demand was high due to the central bank’s negative interest rates, so we increased the issuance of our bonds,” an Ajinomoto representative said.

Corporate bonds are gaining popularity because the yield from government bonds is plunging due to the Bank of Japan’s introduction of negative interest rates. On Feb. 9, the yield on 10-year government bonds dipped below zero for the first time. The gap between yields is continuing to widen.

Regional banks and shinkin banks tend to hold a lot of government bonds as investments, so the falling interest rates have made it harder for them to reap a profit. These institutional investors are diverting their capital toward corporate bonds as they seek higher yields.

“The Bank of Japan buys government bonds from us at a high price, but the interest rate is low,” an official of a regional bank based in the Kinki region said. “We’re looking for investment options expected to generate higher interest, even if it’s only slightly higher.”

Individual investors also are grappling with the same dilemma. Banks have been lowering interest rates on term deposits since the negative rates were adopted. The rate at one major bank has sunk to 0.010 percent, meaning that ¥1 million deposited at a bank for one year would earn a paltry ¥100 in interest.

Mitsubishi UFJ Financial Group will double the scheduled issuance amount of a subordinate bond to be issued this month to ¥200 billion. Although subordinated bonds come with a comparatively high risk, they also offer a higher yield, which the financial group expects will ignite demand among individual investors.

Securities companies are also scrambling to capture more customers. To corporate clients looking to review their investment plan when the next fiscal year starts in April, Mizuho Securities is suggesting they consider purchasing corporate bonds and foreign bonds.

In February, major online securities trader SBI Securities set up a dedicated homepage calling on individual investors to invest in subordinated bonds that offer higher interest rates. “We want to meet the demand from customers seeking to avoid government bonds because of the negative interest rate,” an SBI Securities official said.

Financial institutions and individual investors are also splashing their cash on bonds issued by local governments.

On Wednesday, the Osaka prefectural government solicited bids for its 10-year bond and received applications for about three times the value of the bonds issued. The annual interest rate was 0.095 percent, which marked a hefty drop from around the 0.4 percent and 0.5 percent range offered before the introduction of negative interest rates. Yet it still topped the yield on 10-year government bonds.

“As companies and local governments lower their procurement costs, this will free up money that can be invested in infrastructure and other projects, which could possibly rev up the economy,” said Yasuhide Yajima, a chief economist at the NLI Research Institute.

- March 5, 2016

- Comment (0)

- Trackback(0)