▼ ‘Furusato Nozei’ Donations Sought for Schools

- Category:Other

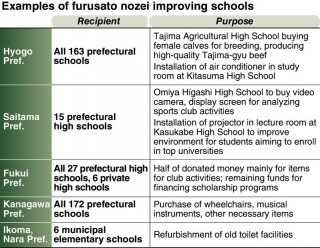

Movements are spreading around the nation to support school education through donations via the “furusato nozei” hometown tax payment system (see below).

Many local governments are in severe fiscal conditions, and some are soliciting donations for specific purposes, such as the purchase of equipment for school club activities or improving school facilities, aiming to garner support for unique educational programs.

Some take donations for specific local schools, encouraging alumni and local residents to donate out of affection for particular schools, and are forgoing thank-you gifts for donors.

New koto for music club

Starting in fiscal 2016, the Saitama prefectural government has sought donations under the hometown tax payment scheme for 15 prefectural high schools that expressed a desire to receive funds through the program.

Each school announces the purpose of its spending and its target amount, and potential donors can choose the school they want to donate to.

Omiya Higashi High School in Saitama, which has a physical education division, would like to buy items for its sports clubs, such as a video camera, a personal computer for analyzing players’ movement, and a large display screen. The school set a goal of receiving a total of ¥25.2 million in donations.

A school official in charge said: “We want to bridge the gap between our facilities and those of private schools, which are strong rivals for our sports clubs, but we can’t afford to buy them just with the budget of our school or with that of the prefectural government. By seeking donations, we want to improve the students’ competitiveness.”

In Hyogo Prefecture, a similar scheme was introduced for all 163 prefectural schools.

One of them, Himeji Higashi High School in Himeji purchased two koto harps in November last year with about ¥700,000 that was donated through the scheme.

The school’s club for performing Japanese classical music is distinguished, having been chosen to participate in an annual inter-high school cultural festival in the Kinki region for two years in a row.

However, koto harps are very expensive, and members said the club had been unable to buy new koto even if old ones were broken.

“The brand-new koto make excellent sounds, so the members are more motivated,” said Kyoka Hayase, 17, a second-year student and the head student of the club.

No thank-you gifts

The schools have high hopes regarding their alumni networks.

Since fiscal 2009, the Kanagawa prefectural government has sought hometown tax payments that allow donors to designate the schools that will receive their money.

An official of the prefectural board of education said, “If alumni associations and other organizations of alumni are firmly organized, it’s easy for such schools to receive donations.”

As of the end of October last year, a total of about ¥480 million had been collected. The schools spent the money for such purposes as converting toilet facilities into Western-style ones, setting up multipurpose rooms and purchasing music instruments.

Recipients of the hometown tax payments often offer thank-you gifts to donors, but some local governments are forgoing such presents in order to utilize all the donated money.

Starting in fiscal 2017, the Okayama prefectural government will seek hometown tax payments for repairing aged buildings of prefectural schools, and purchasing information communication technology devices.

For donors who live outside the prefecture and give money to the prefectural government, local specialty products, such as muscatel wines, are presented as thank-you gifts. But no thank-you gifts will be given to people who donate money for the schools.

A prefectural government official in charge of the issue said, “We hope people who understand our fiscal condition will help the schools.”

Prof. Kaori Suetomi of Nihon University, an expert in the study of educational finance, said: “To get the attention of potential donors, it’s necessary to propose attractive projects. If recipients compete not with thank-you gifts but with ideas, that will boost attempts to vitalize schools.”

■ Furusato nozei

If a person donates money to a local government of their home municipality, or a municipality that they want to support, the amount of the donation minus ¥2,000 is deducted from their taxable income for income tax and local resident tax. Nozei literally means “tax payments,” but the program legally constitutes donations.

Many recipient local governments allow donors to decide how their contributions should be used, such as for disaster prevention or assistance for child-rearing, so the donors’ intentions can be better reflected.

The schools have high hopes regarding their alumni networks.

Since fiscal 2009, the Kanagawa prefectural government has sought hometown tax payments that allow donors to designate the schools that will receive their money.

An official of the prefectural board of education said, “If alumni associations and other organizations of alumni are firmly organized, it’s easy for such schools to receive donations.”

As of the end of October last year, a total of about ¥480 million had been collected. The schools spent the money for such purposes as converting toilet facilities into Western-style ones, setting up multipurpose rooms and purchasing music instruments.

Recipients of the hometown tax payments often offer thank-you gifts to donors, but some local governments are forgoing such presents in order to utilize all the donated money.

Starting in fiscal 2017, the Okayama prefectural government will seek hometown tax payments for repairing aged buildings of prefectural schools, and purchasing information communication technology devices.

For donors who live outside the prefecture and give money to the prefectural government, local specialty products, such as muscatel wines, are presented as thank-you gifts. But no thank-you gifts will be given to people who donate money for the schools.

A prefectural government official in charge of the issue said, “We hope people who understand our fiscal condition will help the schools.”

Prof. Kaori Suetomi of Nihon University, an expert in the study of educational finance, said: “To get the attention of potential donors, it’s necessary to propose attractive projects. If recipients compete not with thank-you gifts but with ideas, that will boost attempts to vitalize schools.”

■ Furusato nozei

If a person donates money to a local government of their home municipality, or a municipality that they want to support, the amount of the donation minus ¥2,000 is deducted from their taxable income for income tax and local resident tax. Nozei literally means “tax payments,” but the program legally constitutes donations.

Many recipient local governments allow donors to decide how their contributions should be used, such as for disaster prevention or assistance for child-rearing, so the donors’ intentions can be better reflected.

- February 1, 2017

- Comment (0)

- Trackback(1)

Comment(s) Write comment

Trackback (You need to login.)

i'm able to find numerous good solutions basically have difficulty!

- buy cheap Albion online gold

- March 25, 2017